The landlord wants to sell the house to me, how should I go about buying the Landlords property?

This is a common question, especially among first time home buyers.

Purchasing a house is an exciting and rewarding process that people look forward to.

It is also one of the biggest investments that you will ever make in your life and should not be rushed.

Before you get serious about buying a house, there are certain crucial things that you need to make sure you have done to ensure that you get to the closing table.

In this post, we are going to take you through crucial steps to buying a house.

1. Check your credit score first

If you are planning to take out a mortgage, your credit score will determine if you will own the house.

So, if you are planning to purchase a house from the landlord, the first important thing you need to do is know your credit score.

Your credit score will determine the amount of interest that the bank will give you and, most importantly, the terms of your loan.

A good credit score not only guarantees that your loan request will be approved by the bank, but the loan will also attract a low-interest rate that could save you thousands of dollars over the entire repayment period.

On the other hand, a poor credit score puts you at risk of not being able to qualify for the loan you are looking for, and if the lender agrees to approve your loan request, it will attract a high-interest rate.

Assessing your credit score will help you determine whether or not you have enough credit score to get approved for the house.

Although credit score varies depending on the credit scoring model, generally, a good credit score ranges from 740 – 799 while above 800 is considered excellent.

On the other hand, a poor credit score ranges from 300-500. And 620 credit scores are considered in the middle.

If you have a good credit score, then you will get a variety of offers from different lenders and the most attractive interest rate for your mortgage.

On the other hand, a poor credit score will give you very limited options and a super high-interest rate for your mortgage.

If you have a poor credit score, then it is advised that you first repair it before you apply for a mortgage.

If you still are OK with having a higher interest rate then there may be a few lenders who are willing to loan you money on a 580 credit score.

Feel free to contact me and let’s go over your options.

2. Get a pre-approved letter from your lender

The Landlord wants to sell house to me is the question and to do it successful, you must assess your credit score, next it time to get a pre-approved letter from the lender.

This is one of the most important processes of buying a house.

The pre-approval process helps the lender to know whether you can repay the requested loan or not.

It analyzes your creditworthiness and shows you how much you can borrow from the lender.

When you get a pre-approval letter, then it means that you will be able to get a loan from the lender so long as nothing changes about your credit score or financial standing.

In hot real estate markets, having a mortgage pre-approval letter is a must for sellers to take your offer seriously.

This is because the letter indicates how much the lender has agreed to loan you, thus assuring the seller that you are able to buy the home.

To get a pre-approved letter from the lender, you need to provide certain information to the lender, such as your income, credit, debts, and assets.

In most cases, the pre-approval process can take up to three days.

However, it is important to note that having a pre-approval letter does not guarantee that the lender will approve your loan when you want to purchase a house.

But, it does increases your chances significantly.

3. You Must Have A Signed Purchase Agreement

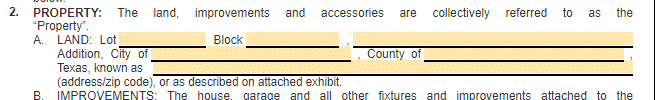

Once the seller has agreed to sell you the house, you need to sign a purchase agreement.

A purchase agreement is a type of legal document that outlines the terms of sale of the house. It creates a legally binding contract between the buyer and the seller.

A purchase agreement includes the following:

Your name and name of the seller

The property legal description and address of the property

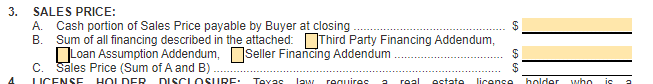

Price

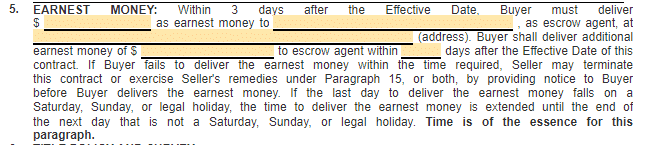

Earnest Money Deposit Amount

Terms and conditions that you and the seller negotiate on

Any chattels or exclusions being sold with the house

Option Period ( This might be different from state to state)

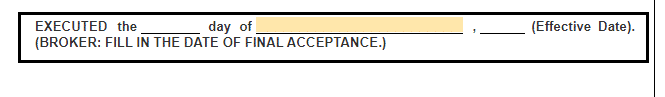

The closing date

As the buyer, you will make an offer on your terms and conditions of the contract, including the offer price in which the seller can either agree, negotiate, or disagree.

Always check your purchase agreement with a lawyer or a conveyance before signing. It is very important to read and understand the agreement before you sign it.

Remember it is legal and binding.

4. Hire a reputable agent to help you

Most people usually think that hiring a realtor is a waste of money, but that is not the case. In fact, hiring a realtor can save you valuable time and money.

If you are a beginner at this then, the one person you need the most is a real estate agent. The Realtor will inform you about the area home prices.

This will allow you to understand what the actual buying price of houses is within your neighborhood.

This is important because it will help prevent you from bidding to high for the home.

Why it is important to hire a real estate agent?

Paperwork

A real estate agent will help you with disclosures and paperwork to ensure that nothing is left out.

Negotiations

Realtors are skilled and good negotiators and will negotiate on your behalf to ensure that you buy the house at the best possible price.

Save your time and energy.

The real estate agent will handle most things on your behalf, making the entire process smooth and hassle-free.

Provide valuable price guideline

The real estate agent knows the market and can give you some understanding of properties within the area and will help protect you from Landlords who take advantage of your lack of knowledge to inflate the price.

Provide professional advice in the closing process

Closing a real estate transaction is a long and complex process.

Several things must be looked at when closing the deal, including things such as real estate taxes, home inspections, cost of repair, and much more.

A real estate agent can help you out to ensure that nothing goes wrong.

The agent can help you open the title.

The real estate agent can help you open the title to see if it has no liens and is error-free.

5. Inspect the house

A home inspection is a crucial part of the home buying process.

Having the house that you are planning to purchase inspected will help you know any damage or signs of structural wear.

Hire a certified general contractor in your area to inspect all major systems throughout the house.

Besides checking for defects in a home, you can also use the home inspection as a negotiation tool.

For instance, if the inspection shows many defects, you can negotiate for a price reduction.

| Ways a Home Inspection Can Help |

|---|

| Detect safety issues |

| Reveal illegal installation and additions |

| Detect the presence of a hazardous product |

| Important Inspection Checklist |

|---|

| Electrical Outlasts |

| Window Alignment |

| Insulation |

| Pipe and Septic Tank Leaks |

| House Ventilation |

| Basement and Garage Foundation |

| Wiring |

Wait on loan to process

Once you have inspected the house, agreed on the price, and have a written agreement, the next step is applying for the loan and wait for it to be processed.

But once you submit your documents to the lender, the lender will have the house appraised.

The home appraisal usually occurs after you accept the offer and after an inspector has reviewed the home.

Once you and the Landlord have agreed on the price, the lender will send in an appraiser to assess the fair market value of the house.

The seller can also get a pre-selling appraisal. The main goal of an appraisal is to determine the real value of the property.

All lenders conduct a home appraisal before issuing a mortgage.

The appraisal process can take anywhere from 15 minutes to several hours to complete, and the report can take up to 10 days to come out.

The lender usually shares the report with the borrowers once it comes out, and they use it to determine how much money to lend.

During the loan processing, the lender will gather your documentation and review all data provided.

Once you meet all requirements set by the lender, your application will be approved and payment processes. The entire process takes about two weeks.

Submit all crucial paperwork and close

This is the last and also the most important step in buying a house. The process is lengthy and quite complex.

That is why it is important to seek the help of Realtor and Real Estate Closing Attorney or Title Company.

At closing, it will be you, the closing Title Company Officer or Closing Attorney, and your LandLord who will be scheduled to close at a different time.

| Important Documents for Closing the Deal |

|---|

| Official Identification |

| Sale Agreement |

| Insurance Document |

| Certified Check of Your Down Payment |

| Closing Cost |

Conclusion:

Once everyone involved has agreed to the terms and have signed all the necessary documents and paid all fees, the deal will be ready to fund and close.

It is important that you understand that your deal is not considered closed until lender documentation is sent to the title company and all fund wires are processed.

Make sure that you understand this part. Your official lender documents have to be sent over to the title company which will include your warranty deed. Once done, Congratulation you are officially the new owner of the house.