Real estate is one of the highest investments many people will ever make, so it’s important to know what it entails

When you sell a home, there are often additional charges which go along with the sell of the home.

Closing costs are related to the offer price that is accepted by the seller.

The total amount of these costs varies depending on where the property is located to other properties in your area as well as other factors that may be unique to your situation.

This post will outline some of the more common closing expenses for homeowners selling their homes.

Here are some of the most common known question that most sellers ask.

What are Closing Costs?

Closing costs are the expenses that a seller has to pay when they sell their home.

They cover the final transfer of ownership and include items such as title search, deeds, liens, preparation of forms and agreements, and all other costs required for the transfer of ownership.

They are typically broken down into two categories: out-of-pocket expenses and loan charges. Out of pocket, you might need an appraisal fee, title insurance survey fees as well as attorney fees along with Real Estate Commission (commission is a percentage paid to brokers or agents for their services).

There are other considerations as well, such as the lender payoff amount.

Who Pays Closing Cost?

When you’re selling a home, there are important questions that need to be addressed. You and your real estate agent will have many conversations about the different aspects of what’s included in the sale price, and the last question you might your realtor is how much do I pay in closing cost?

So who is the one that flips that bill when you are happily excited and ready to take it down the court for a slam dunk to get the home closed?

Answer: This is negotiated at the time you receive a offer from the buyer. There are a few scenarios to consider when negotiating who pays closing cost.

Scenario 1: Your home needs a lot of work and you know it will not go FHA or Conventional. In this scenario an investor might come in and offer you cash for you home and offer to pay all the closing cost.

Scenario 2: You have the home listed and you have a buyer who is giving you the asking price.

On the agreement you checked off seller will pay title policy, and for a survey.

Also in the scenario, you see where they have checked off seller to offer Home Warranty and 3k in closing cost assistant.

Here, the buyer will pay normal settlement costs, along with their prorated taxes amount and normal closing fees associated with the title company.

You will be paying for the title policy, survey amount, Home Warranty amount, and closing of 3k along with prorated taxes, real estate commission, and closing fees associated with title company.

Scenario 3: A offer comes to you where you will pay your portion of the closing cost and the buyer will pay their portion of the closing cost.

There is no asking that you pay for survey or sellers concession( This is where you will help the buyer with their closing cost)

In this scenario, you will pay title policy, prorated taxes, real estate commission, and title company closing fees.

What is the Closing Process?

The closing process is often the last step in the real estate transaction. This process normally starts the moment you decide to accept a buyer’s offer.

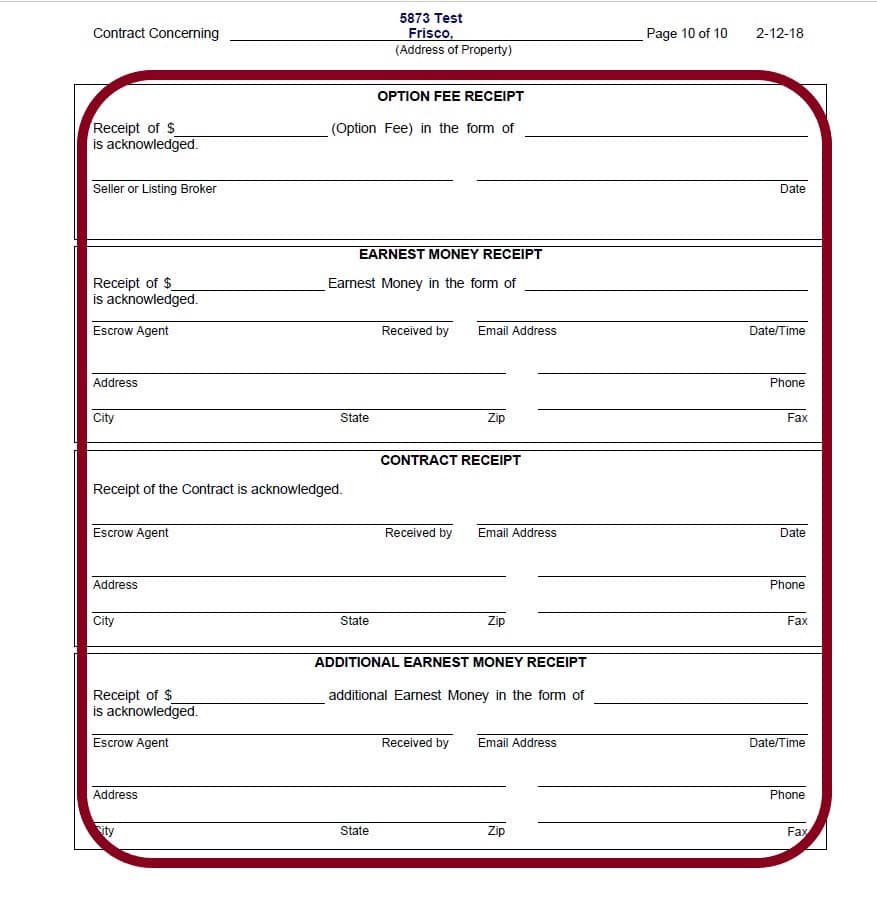

When a buyer’s offer is accepted, there may be one or two separate amounts that buyers agent or buyer will take to the title company.

When an offer to purchase is accepted, it’s possible that the buyer’s agent or the buyer will take one or two separate payment amounts to the title company.

The first check will be the earnest money deposit and the second check will be for the Option Period( If there is no Option Period then it will only be an earnest money check)

In some cases, there will be just one check with the amount for earnest money and option amount.

Once this amount is taken to the title company a title search is open on the property.

There are some cases where it might even be a good idea to try and get a preliminary search done on the property even before you accept an offer to make sure there are no surprises when it’s time to close.

The payment amount is then handed to an escrow officer who will then accept the payment amount and write it on the Real Estate Contract page 11.

They will normally Receipt it by signing it and dating it

The file is open (open title). From here they will get all of the records, liens, and information about the property on the title and issue a title commitment and title policy.

Once they have all information and both parties agree to the title commitment and they have the seller’s payoff amount along with making sure there are no other outstanding liens, then the escrow officer waits until the Seller and Buyer gets past the option period, inspection, and appraisal from the buyer’s lender.

If the buyer is happy with the inspection report and the appraisal comes back appraising for the amount that was agreed upon, the file is now ready for the loan officer to request the documents be sent to the title company.

Remember, (if the paperwork from the buyer lender is not at the title company then its a strong chance the deal is not closing. It’s important to make sure the buyer’s paperwork is at the title company. You do not have a closed sale until it has been funded )

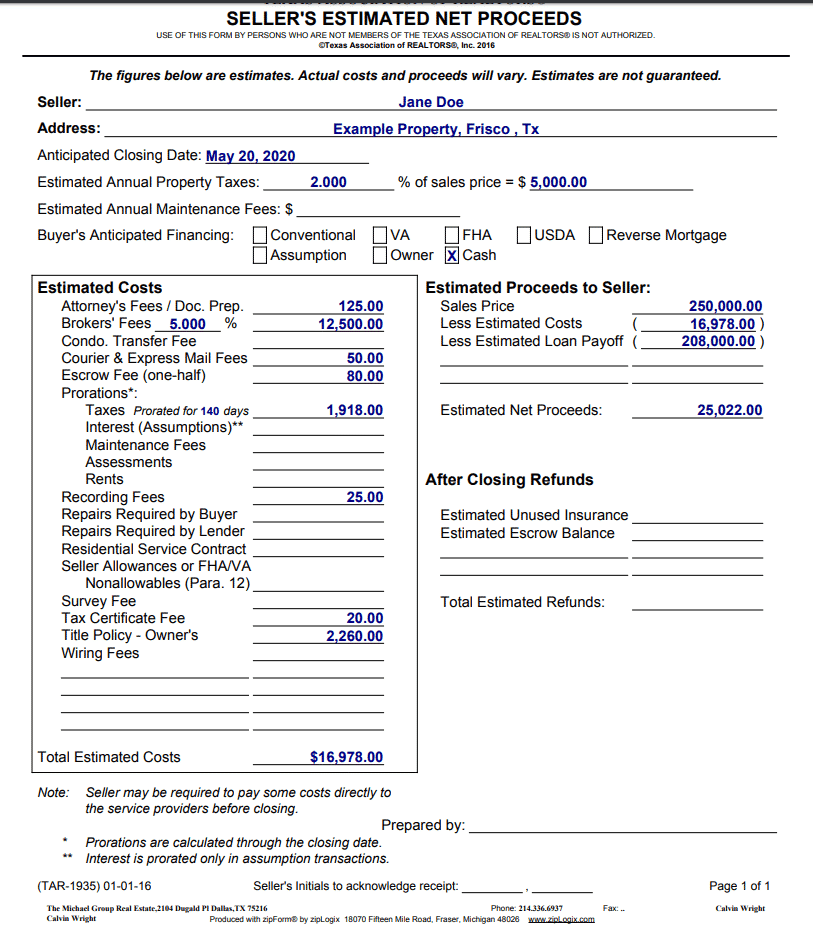

Once the buyer’s lender has sent the docs to the title company the escrow officer will work up a closing statement or settlement statement that will list all of the seller closing cost and the buyer’s closing cost on it.

Before you go to closing, you’ll receive a settlement statement final draft. When reading through it, be sure to check for any fees, Real Estate commission and closing cost as well as your loan payoff amount. Make sure that everything is correct.

Tip: Remember to call your lender as soon as you close and ask for a refund for the insurance policy you paid in the escrow account.

The closing table is usually a desk or conference room table where you will sign the documents. If you are unable to attend in person.

Some title companies offer mobile closings or closings where they will send you the documents and you will have to return them notarized and signed.

The most important things you need to bring to the settlement table are your driver’s license, your social security number, all keys to the property and garage door openers, any known warranties on appliances or AC and Heating unit, copies of warranties on repair work that was done on the property.

A Comprehensive List of All Closing Expenses For A Home Seller

The closing process entails so many expenses that can leave a homeowner feeling overwhelmed. Here is a comprehensive list of all the closing expenses you may incur:

1. Title Policy. This is an insurance policy that covers issues that might cure on the property as far as liens, easements, or encroachments.

To figure out your policy premium you can go to TDI.texas.gov. TDI stands for Texas Title Insurance Basic Premium. On their website, you can figure out how much it costs to pay for title insurance. It will also tell you how to calculate the title policy amount if your home is over an certain amount.

2. Recording Fees. Fees that are paid to record the deed or mortgage in the county records office. The title company will have this information on pricing.

3. Surveyor Fee (if required). This is paid to the surveyor who does an updated survey on the property. This fee varies and your local title company can give you this estimation.

4. Notary Fees/ Courier Fee/ Mail Fee (usually included in Closing Costs. The notary fee for notarized documents, and the courier fee and mail fee are for documents that have to be couriered to you by courier service or sent to you via mail.

5. Attorney Fee and Doc Prep. The Attorney Fee and Doc Prep is a charge that is necessary to prepare the legal documents. Call your local title company to get this fee amount.

Legal Documents include loan documents, escrow agreements, title reports, survey area reports, the release of liens, property descriptions, and more

6. Tax Certificate fee. The tax certificate fee when selling your home is a one-time charge paid by the seller. This fee ranges in most areas and it varies depending on the county or state where you live. Call your local title company to get this fee amount.

7. Seller Concession. Sellers often make concessions to buyers when selling their homes. These concessions are paid as a part of sellers closing costs. This amount is credited to the buyers on their closing cost statement.

8. Real Estate Commission. The real estate commission is a fee paid by the seller to the broker who helps in the home selling process.

The commission can be subtracted from the purchase amount of the home and will be shown on your closing statement at closing.

9. Loan Payoff Amount. When you get ready to close on your home it’s very important that you make sure you get a payoff from your mortgage company.

Simply call into your lender and request a payoff amount. When they ask you the good thru date make it good for at least 30 days.

If for some reason, your home doesn’t close according to the closing date, make sure to update the payoff amount.

10. Prorated Taxes. The local government often requires that sellers pay taxes on the sale of a home. If you are the Seller, you are expected to pay taxes up to the point of your closing date.

This is why it is called prorated taxes. Each state is different and you can take with your escrow officer or closing officer about prorated taxes.

11. Home Warranty. Home warranties are an essential part of any home purchase. They offer protection against the unexpected repair costs. Fee averages around 475.00 to 600.00.

The seller can pay for the home warranty at closing for the buyer.

This means that if the buyer has a problem or have minor issues with appliances or heating and cooling system, the home warranty may cover it.

Each Home Warranty is different and they have different plans available. Normally the buyer will choose the company.

12. Judgments or Other Liens. Judgments or liens on property can be paid off before the seller closes. If the seller doesn’t pay off these debts, then the will need to be paid at closing.

The most common reasons for a judgment or liens are unpaid IRS liens, Contractor Liens, Credit Card Judgment liens, and unpaid loans.

The title company will prepare the release of liens at the time of closing. In some cases, if some liens are not able to come off then there will be a cloud on the title and possibly the title company would be unable to issue a clear title on the property.

It is possible that the title could still be passed to the buyer but it would be considered an uninsurable title policy.

You will need to talk to the escrow officer and make sure you understand this if the property has judgments or other liens on the property.

Conclusion

If you are thinking about selling your home, it’s important to remember that there will be closing costs.

Closing costs varies depending on where you live and can range from 2% to 8% of the purchase price

Some common items included in a typical closing cost package include an escrow fee, title insurance, survey fees or other closing expenses such as real estate tax service fees, payoff amounts and seller concessions.

If you’ve found this article useful and would like more information on any given topic discussed here, just let us know! On that note, we always love hearing from our readers so don’t hesitate to reach out if there’s anything else you want to learn about or share feedback with us.

If it was helpful to you please make sure you share it with your friends, family, on social media or co-workers.