Many people are unaware of the costs that go into buying a home. Closing costs can be quite expensive and when you’re looking to buy your first home, this is something you should take into consideration before making your decision. What Are Closing Cost When Buying A Home?

This blog post will discuss what closing costs are, why they exist in the first place, and things to keep in mind when you are ready to close on your home!

What are Real Estate Closing Costs?

When you buy a home the first thing you might ask yourself is what are Real Estate Closing Costs?

The answer to this question is simple. It is the cost that buyers endure when they are ready to purchase a home.

What you have to remember is this.

In everything you do, there is a cost of doing business. When you buy your car you have to deal with some cost to close on that car.

That would include taxes, title and license, and your down payment, and normally fees associated to take the car off the lot.

The same thing would go for when you are buying a home or property.

When you buy a home there are certain fees that you have to pay to close on a home.

In Real Estate this is known as Closing Cost. This makes up the entire closing cost in a Real Estate Transaction.

What are closing cost for?

So you are asking the question what are closing costs for? Closing costs are fees associated with the title company, mortgage loan, and local government taxes.

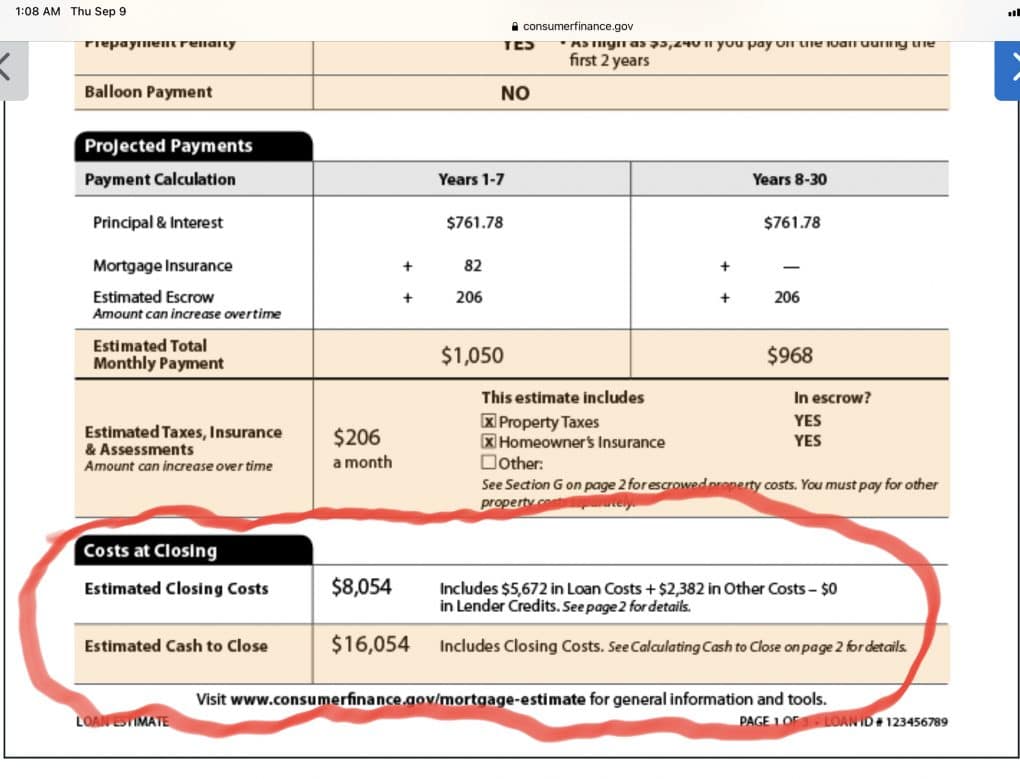

When you went through the loan process the loan officer handed you a Loan Estimate form.

When you review this form This form gave you information about what you would pay at closing which would be your loan closing cost amount.

On this form, you will see your Loan Amount, Interest Rate, and your monthly Principal & Interest payment a month.

The part you want to pay close attention to is Cost at Closing. This area will give you the estimated closing cost you need to pay at the title company.

These are normally lender-associated fees with that lender charges to process the loan as well as your down payment used in conjunction to give to the bottom line investor who is the financed backer of the loan. (Normally this is a lender institution, Fannie Mae, Freddie Mac, FHA government back loans, VA, or private investors.

More on this in the later paragraphs.

So what closing costs are, they are fees you will incur when closing on a home.

The closing costs that you’ll incur when buying a home can range and there are a few things that we can do to help you understand what they are.

What Is In Closing Cost?

Now let’s take a look at what is included in closing costs for buyers. When you buy a home, you have fees that are necessary to close on your home.

It’s important to know what they are so you can plan for them. There are a few things to consider when knowing what’s in the Buyer’s Closing Cost.

But, when we ask the question what is in the closing cost. We have to answer this question as follows:

In a typical Closing there are two sides. You have the Seller’s Closing Cost and the Buyer’s Closing Cost.

The seller closing cost will consist of prorated taxes, Real Estate Commission, title company fees, and title policy.

Sometimes the other fees they will pay will be Sellers Concession, Mortgage Lien Payoffs, Home Warranty policy if this was negotiated that the Seller would pay it.

Judgment liens payoff. ( if it applies)

When we get to the Buyer’s Closing cost. The buyer’s closing cost normally consists of a few things as well. The Buyer will have title closing cost, Buyers Down Payment, Lenders Closing Fees, Appraisal Fee, Survey Fee (If the Seller Doesn’t have an existing one) Real Estate Commission (if for some reason the Seller Doesn’t Pay All ), Title Policy (Only if the buyer has decided to pay the title policy.)

What does Buyer Pay At Closing?

The closing cost is what you will pay the lender at the time of transferring the property.

As stated in the above paragraph we gave some information to you about what buyers will pay at closing. Now let’s go over the closing cost process for the buyer.

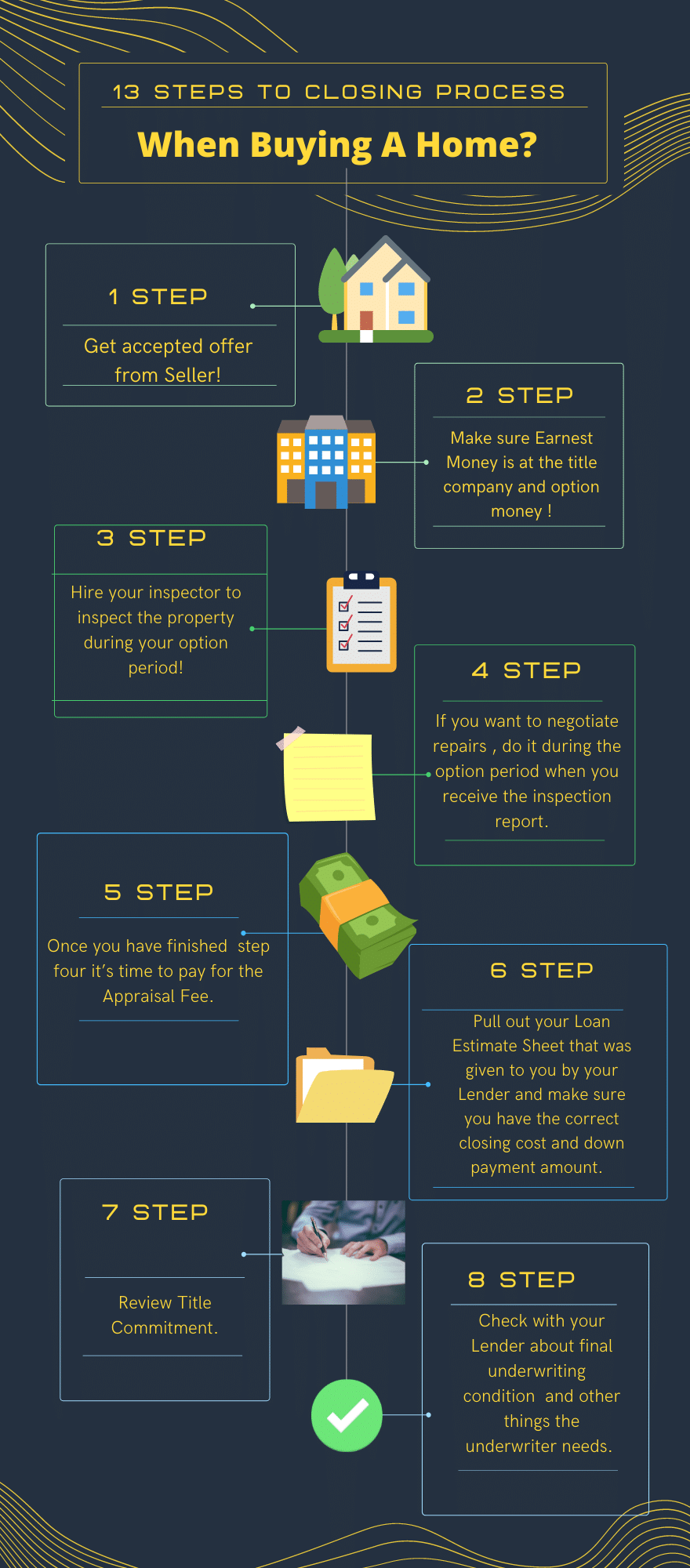

You have now made your offer to the seller. The seller has accepted your offer. You have gone thru the process of inspection and now we are ready to work to close on the property.

One of the things that will get done is the Appraisal will be ordered. Once this is done. There is a delay waiting on the Appraisal to come back. Two things could happen.

One, the Appraisal comes back at the accepted offer price that you and the seller agreed on or the Appraisal will come back lower than the accepted offer price.

Two things can happen here. You will either have to bring the difference of the Appraisal amount to closing, along with your other closing cost expenses or you will have to see if the owner will give you a price reduction.

Once this has been decided. You are now moving towards going to closing.

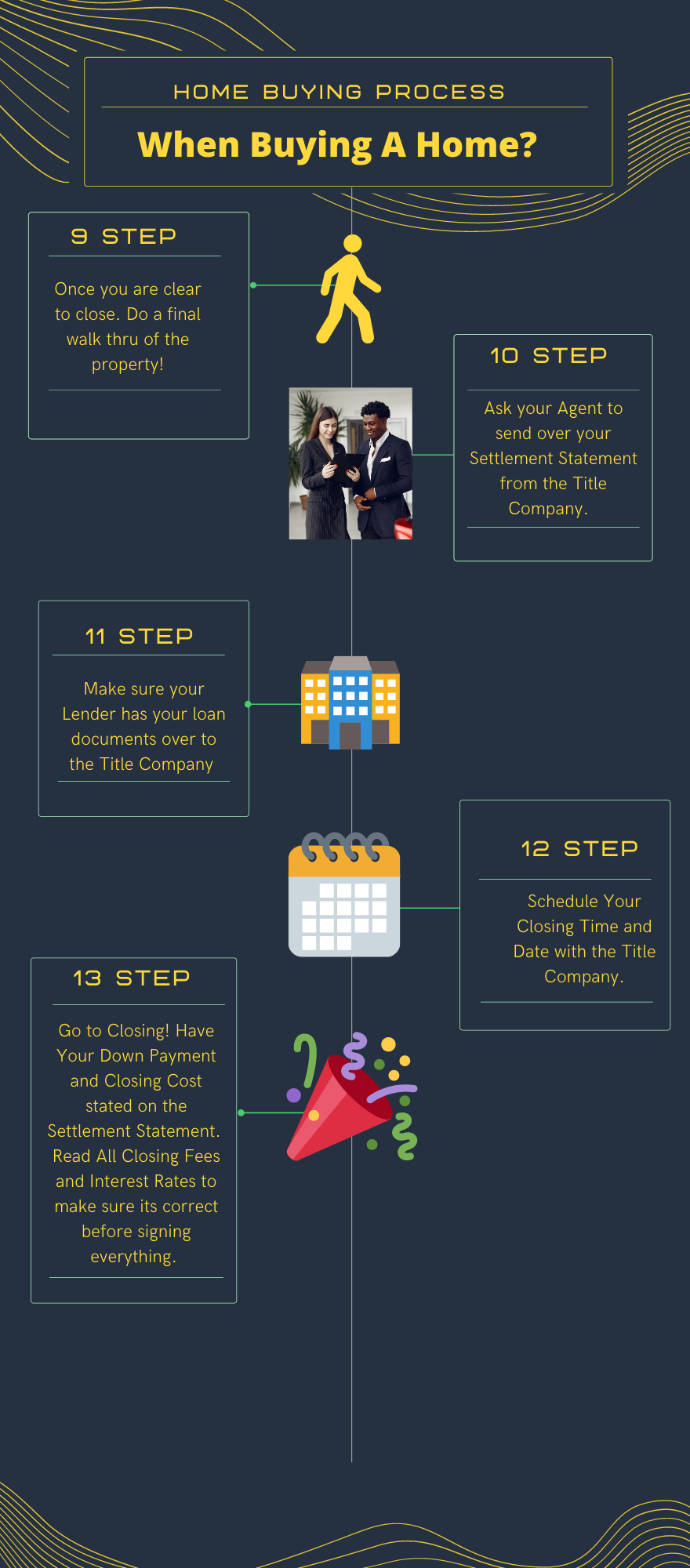

Your lender will prepare the documents and then they will have this information sent over to the title company.

The title company will then give you a settlement statement. On this settlement statement, there will be a list of your closing cost and expenses.

This will tell you the amount you need to bring to closing. The following is a list of items that will be on this.

Buyer’s FEE Chart

| Type of Fees | Description | Answer |

|---|---|---|

| 1. Recording Fees | A fee associated with the title company, paid by the buyer at closing, to record the new deed of the property with the buyer’s information. | Contact your closing agent with the title company. |

| 2. Surveyor Fee | A charge for using a land surveyor to inspect the land. This fee depends on the country, state, or province and the size of the project. | Contact the title company. |

| 3. Notary Fees/ Courier Fee/ Mail Fee | Fees for notarized documents and for documents that need to be couriered or sent via mail. | These fees are typically itemized in the closing documents or can be provided by the title company |

| 4. Attorney Fee and Doc Prep. | A fee for preparing legal documents, such as loan documents, escrow agreements, title reports, and release of liens and property description when buying a house. | Contact your local title company. |

| 5. Loan Origination Fee | The cost of doing business with your lender. Each lender might have a different loan origination fee. | Ask the lender about their closing cost fees or loan origination fees during the interview process. Shop around to compare fees. |

| 6. Termite Inspection (WDI Report) | A termite inspection report used to determine if there are any termites or other pests that could cause structural damage to the home. | Report is Ordered by Lender. Arrange for a termite inspection and obtain the WDI report. |

| 7. Real Estate Commission | A fee agreed upon when signing a Buyers Representation Agreement with a Real Estate Agent for their services in showing properties. | Refer to the Buyers Representation Agreement signed with the agent. |

| 8. Prorated Taxes | The buyer’s share of property taxes, calculated based on the date of closing. | Contact your title company for prorated tax amounts. |

What if my down payment funds are gifted to me?

If you have a relative who would like to gift you down payment funds this can be possible. But the person who gifts you the funds must be an immediate family member. This means (Mother, Father, Grandparents.)

If they offer to help you fund your purchase, the lender has to be able to trace the money back to an account owned by a family member. (This means a 401k, IRA, Savings, Checking Etc.)

What if I use a down payment assistant program or first-time home buyers program?

If you qualify and meet the criteria you might be eligible for down payment assistant and closing cost programs.

These programs will help you if you feel you don’t have enough money for closing costs or down payment costs.

A second lien will be placed on the property, which will become due and payable if, for any reason, you sell your home before the forgiveness date specified in the terms of the agreement.

Or, if you manage to meet all the terms of the agreement for the program, the amount will be treated like a grant or forgiven, meaning you won’t have to pay it back.

Three known down payment assistance programs are:

How do I calculate lender closing fee?

There is a method that you can use to figure out what is your lender closing cost and I will give you a detailed example.

Say you are going to make an offer on a property for 450k. You have talked to your lender and you find out that the lender closing cost fee percentage is somewhere around 6%.

How would you calculate your closing cost amount?

To give you an estimate simply take. $450,000.00 and multiple it by 0.06. This will give you $27,000.00.

For your closing cost. This doesn’t include your down payment, Appraisal fee, Inspection fee, or Termite Inspection fee.

Typically a Buyers Agent would normally be paid when the transaction has been complete and is normally set by the Listing Agreement.

In the Listing Agreement, the Listing Agent will set the co-op agent fee. This fee can range.

There must be an understanding that typically if you and your agent agree that a 3% fee is due and payable to your agent on the Buyers Representation Agreement and the agent shows you a house where the co-op fee is 2%.

Then the buyers are responsible for making sure their agent is paid the other 1%. This is based on the Buyers Representation Agreement that you signed with your Agent.

Also in the Buyers Representation Agreement, there might be a fee to get started with the agent.

This fee is charged to ensure that you are serious about buying a property. And this upfront fee could also vary.

It’s done to ensure that you are not wasting the agent’s time showing you homes and you decide to not buy.

Remember, time is money and the agent is taking the time to make sure you see properties so they deserve to make their commission and fees.

There may also be a termination fee that is put in the Buyers Representation Agreement.

This fee is there because sometimes things happen and you might not be in the market to buy anymore or you might decide that you want to use a different agent.

Therefore a termination fee is charged to terminate the agreement between you and your Agent.

Conclusion

Hopefully, this article has given you a better understanding of what your closing cost is when buying a home.

Buying a home is one of the most expensive purchases you can make in your lifetime. An insightful article on closing costs is an important read for any homeowner or future homeowner.

Thank you for reading this article. If it has been helpful to you, feel free to leave us your thoughts in the comment section below, and don’t forget to share this article with loved ones or with anyone who might find this article useful.