In the following paragraphs we are going to discuss in details about the 203k loans and how the process works. You will learn more about the process and how to purchase a home using the 203k Loan.

Normally, when thinking about the 203k loans most people have never really heard about them. Most the times you have heard about the 203B loans which are mostly the standard loans that most people get when they go FHA. But did you know that with a 203k Loan you are able to purchase a home that needs repairs? Think of this loan as a gift to you as a buyer. Why would I say that? Because with this loan you will be able to satisfy all deficiencies code violations, kitchen, roof, windows, termites etc.

This loan will also allow you to upgrade a home with new paint, carpet, windows, doors & appliances, etc.It allows you to design a home the way that you want to. So now when you look at that home that needs a lot of work you can possible look at it in a different way due to having this loan. To simply put it, it’s an FHA loan that includes money for Home Improvements & Repairs.

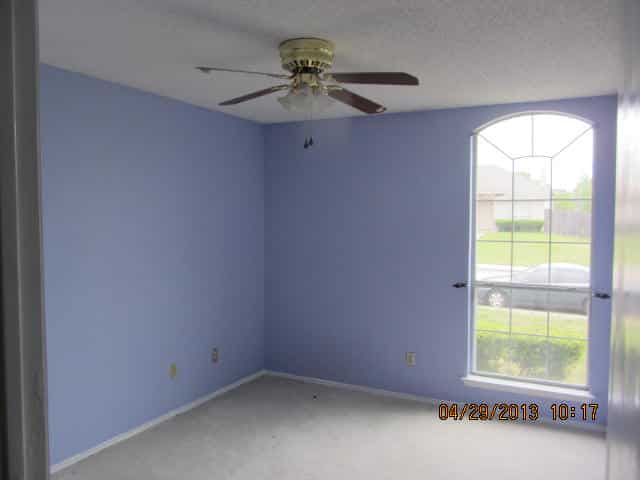

This is home needs a lot of repairs. But this home can still be purchased thru the 203k loan

This is how it can look after you finalize your 203k loan.

What is an FHA 203k Loan?

To simply say it: ” It is an FHA Loan that includes money for Home Improvements & Repairs. The 203k is one of the most important yet least utilized government loan that can help revitalize the Nations aging housing stock.

The 203k Loan can create renovation jobs. It help move slow selling properties that needs a lot of work. It can help a buyer close “as-is” on any property in any condition. All repairs are completed after the closing by the buyer and his or her contractor. The house is appraised “as- repaired”

Why would FHA insures the loan on a distressed property?

The reason why FHA would insure loans on a distress property is because it helps buyers qualify for properties that would not be able to be insured thru regular financing. In a regular transaction, buyers are using regular conventional financing or FHA 203B Loans.

In some cases when inspections are done and when appraisal requirements come back. Sometimes the appraisal requirements might require major repairs that could prevent the home for qualifying for this type of financing. Some of the things are holes in the walls, Foundations that needs repairs or even roofing issues.

This type of loan provides the ability to cure all deficiencies and allow improvements to be itemized on a report from a trusted source. When dealing with this type of loan a licensed contractor has agreed to do the work on the report for a specified price. If you need help with understanding how to shop for a handyman or contractor see the post in reference to finding the right handyman/contractor.

Benefits of Renovation Financing

There are many benefits to this program. Some of the main benefits to the program would be a buyer can purchase a property “as is”. There are no repairs that are need to be made to close. This is a benefit because the property will not be held up due to appraisal conditions.

If the house has a leaky roof then it would be ok. If there are no appliances then its Ok as well. If there is no carpet on the floor the home will still qualify. Cracked slab is ok. If there is some fire damage the property would still qualify. If the property have code violations the property would still qualify.

The benefit to the buyer is the ability to customize the home. This means you can customize the home to look like you want it to look. Buyer would be able to look at distress properties and still be able to close on the property.

The benefit to the seller would be the ability to sell to a retail buyer, not a investor looking for the lowest price point. Seller can sell the properties “as-is” No out of pocket expense needed to repair the property. Buyer does all the work after closing. The property is appraised at “renovated” value.

To give you a better overview of the process you can check out this infographic below:

What properties are eligible for the 203k Loan

The following are list of properties that are available for a 203k Loan:

- Attached and detached Single Family Homes

- 2-4 unit properties

- Condominiums in FHA -approved projects (max 4 units per structure)

- 5 plex to 4 plex

- 8 plex to 4plex

- SFR to 4plex

How does the required improvement work?

A HUD Consultant or Home Inspector visits the property and reviews minium health and safety requirements as determined by HUD. Some examples would be termite work, well & septic, smoke detectors, plumbing, heating & electrical systems, Window, doors, Roof & foundation.

A HUD consultant then approves one general contractor to oversee all of the home repairs. The contractor then creates an itemized bid for the labor and materials required for each step of the home repairs of renovation. The contractor gets nothing up front, but rather is reimbursed by the HUD consultant after each step of the repair process. The HUD consultant then issues draw requests for funds after each portion of the repair is finished.

Work Must Be Completed by a Licensed Contractor

The work must be completed by a licensed contractor… Please keep this in mind when you are doing a 203k loan. The contractor must meet the following qualification:

- Must be Licensed and in good standing with the State License Board (If there is a State License requirement)

- General Liability Insurance

- Workers Compensation Insurance

- Must Supply bid equal or less than Consultant Report on Contractors Letterhead

- Contractor must complete the required forms: Profile, W-9, Homeowner-Contractor Agreement, Notice to Contractor

When dealing with the contractor remember these things: Contractor can start his work right away after closing but the first draw won’t be available until approximately 45 days after closing. There is a 10% hold back on each draw until final draw. Inspection must be performed each time draw is taken unless Streamline $50,000 minimum loan amount due to Statutory Limits.

Streamline 203k Loan

The streamline 203k Loan is designed for less complicated repairs. Its not for structural improvements. Hud Consultant not required but a home inspection is required. You can not finance any Mortgage payments into the loan. Maximum Repair budget $35,000.

What repairs are ineligible for the streamline program? Repairs that might require more than 6 months to complete. Anything that is major rehabilitation or major remodeling, such as the relocation of a load-bearing wall. If you are doing new construction, including room additions. Repair of structural damage to a home. Any work that is going to displace the homeowner for more than 30 days. Also any work that is over the maximum repair of $35,000.

What Happens After Closing on a 203k Streamline Loan?

The following infographic gives you a idea of what happens after closing. Remember to consultant with your lender in reference to the this process.

So what repairs are eligible for the 203k Streamline?

The following are repairs that are eligible for the 203k streamline program.

- Plumbing & electrical systems

- Windows and doors replacement

- Install insulation

- Replace HVAC Minor

- Remodeling such as kitchens – no structural repairs

- Interior and exterior painting/siding

- Roofing, gutters , downspouts

- Existing floors / floor treatments

- Landscaping and site improvements

- Enhancing accessibility for a disabled person

- Making energy conservation improvements

Standard FHA 203k

The standard FHA 203k loans pretty much covers all necessary repairs that are need to the home. The full 203k is used for major structural reconstruction and extensive repairs, usually. In addition the full 203k requires a HUD consultant. A HUD consultant is simply there to look over the project and make sure that good quality work is being done in a timely manner. Keep in mind that if you are looking to add solar panels to your home the 203k loan is a good possible solutions to being able to add solar panels to your home.

What happens after closing on a Standard FHA 203k Loan?

The following infographic gives you a idea of what happens after closing. Remember to consultant with your lender in reference to the this process

So what repairs are consider Standard 203k?

- All of the improvements for the streamline plus: Changes for improved function and modernization

- Adding on a room

- Window Coverings, Appliances, Indoor Jacuzzi

- Major landscaping and site improvement

Remember doing the Standard 203K Loan does require a HUD Consultant. When offer is written by your Realtor you realtor can add the following language to special provisions that says: “Buyers have applied for FHA 203(k) Renovation Financing at 96.5% LTV. No seller repairs will be required to close, all repairs are financed in buyers loan.”

Conclusion:

The 203k Loan can be a effective loan to use when you are trying to buy a home that needs minor repairs or major repairs. It can be a benefit to a seller who is trying to sell their home “as is”. Remember, there are 2 types of 203k loans: Streamline and Standard loan. Also remember to find a lender who specializes in these types of loans. It creates a win, win situation for both sellers and buyers. IF you would like to buy your sell your next home feel free to contact me.