You can’t buy a house with just your emotions, but you can buy a home by using some good common sense.

If you’re not sure about something or have any doubts, stop and take a step back. You’ll thank yourself later because you decided to make sure you are doing what’s best for you.

“So, when to walk away from a house?”

We know how hard it is to find your perfect match and sometimes, despite our mind telling us otherwise, we might find ourselves needing to walk away.

So what do you need to consider before walking away from that perfect house?

This article explores when it might make sense for you as a home buyer to know when to walk away from your dream home.

If the House Is In Need Of Major Repairs

If there are too many problems with the house that needs to be fixed, then it might eat into your move-in budget.

This is something that every buyer of properties should make sure they understand.

You need to understand how much it will cost to fix the repairs of the home.

You will normally start to see this when you set your appointment to view the home for the first time. Sometimes your Realtor will point out some things in the property to pay attention to as well.

During your inspection time, it would be a good time to see if you can have a Licensed General Contractor come out and give you some idea of how much it would cost to fix it up.

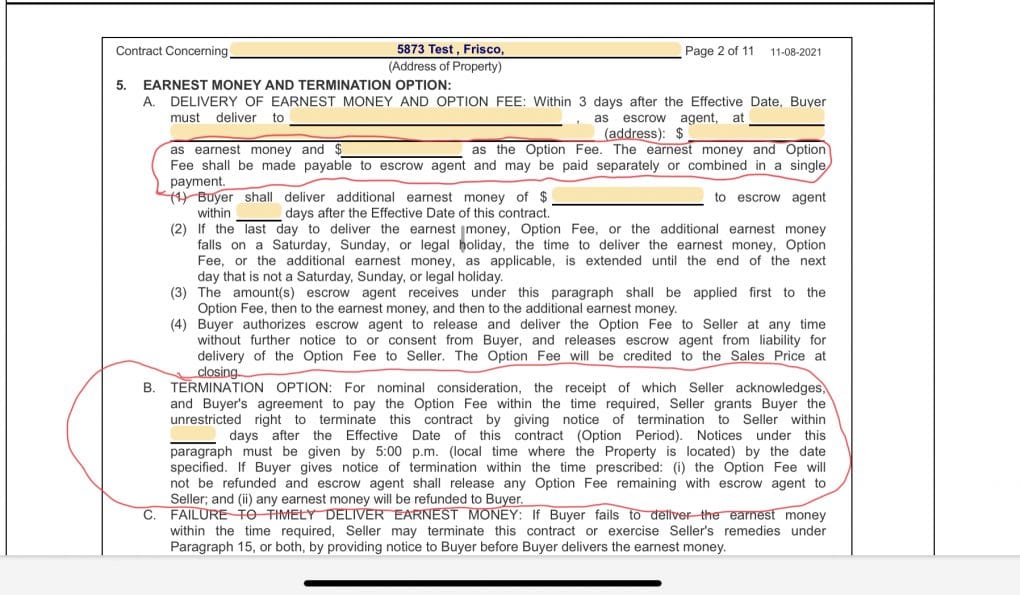

This can be done during your Option Period. So how does the Option Period work? The Option Period allows the Buyer to walk away from the home.

No matter what the reason might be, you can say that you no longer want to buy the home and opt-out.

Always remember that if you are unsure about the cost, you want to bring in Contractors who can give you quotes on getting things repaired.

When a house is too expensive for your budget

If you are looking for a home, it is important to know what your budget is.

A lot of people who are looking for homes are discouraged because they cannot find anything within their budget.

You can either look for cheaper homes or make adjustments to your budget to allow you to look at higher-priced homes.

There are many reasons why a house might be too expensive for someone’s budget.

Never buy a home based on emotions alone. Make sure you know the bottom line budget.

You must also make sure that you include the taxes, insurance, and PMI (Private Mortgage Insurance) when applying.

It’s always a good idea to use a mortgage calculator that includes the Taxes and the Insurance.

One of the main issues that people run into when buying a house is the increase in taxes and insurance.

The important thing to know: Taxes and Insurance could increase over the years.

So you must consider this when you are buying your home.

Be careful when you are in a bidding war. Make sure that you know your limits and your stopping point.

Bidding wars can cause you to get into your emotion and when you are in your emotion you might go over the asking price.

If you are ok with that then, by all means, make it happen.

Know that if the Appraisal comes in short you might be responsible for paying the difference if the Seller chooses not to lower the price to the Appraised price.

If for some reason you find yourself where you have won a bid and you are wanting to back out of buying the home.

You must remember to do so by relaying the Option to not buy the home.

Again this would be your way out of buying the house. The Option Period.

So make sure that you understand that this is one way out.

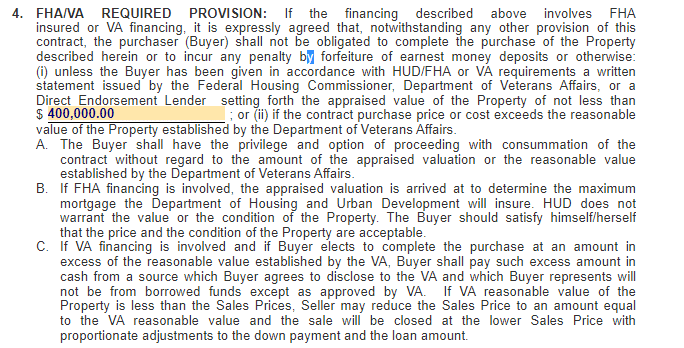

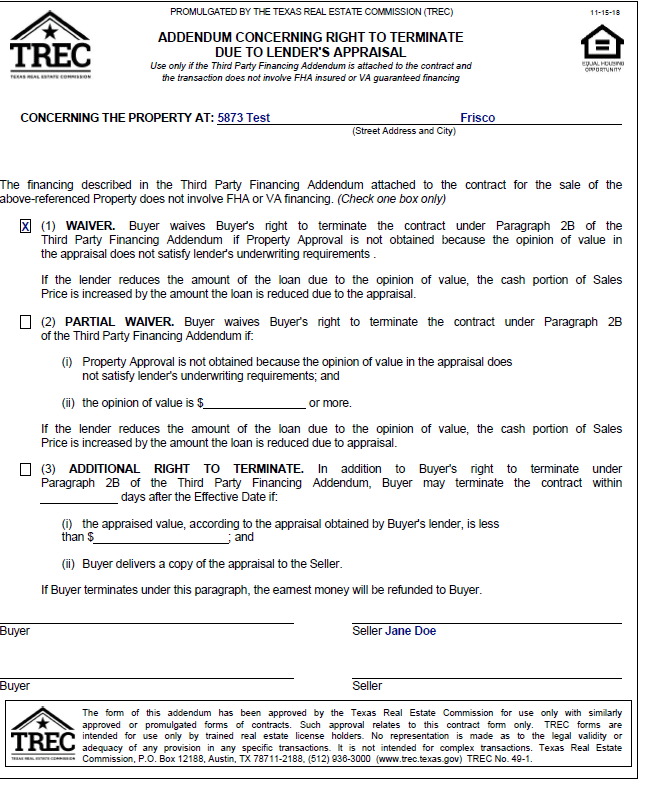

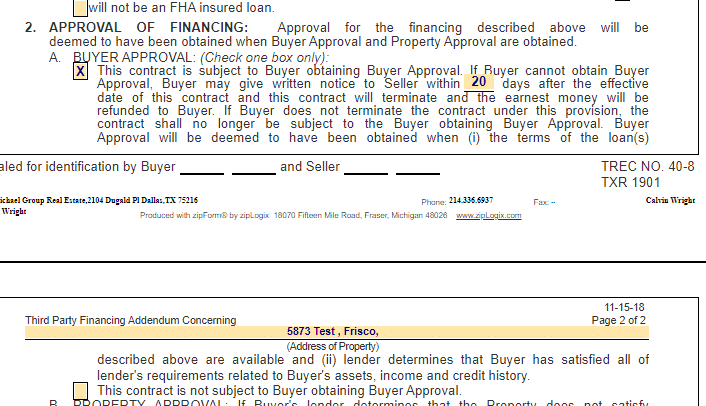

The other way that might allow you to walk away from a house is the Third Party Addendum.

In the Third Party Addendum, there is a statement in there that talks about the price of the home.

If you are going FHA and VA there is a clause that your agent will fill out the part where it says not to exceed a certain purchase amount.

They will put in the amount saying that if the home doesn’t appraise for this Appraisal Amount then the buyer can choose to terminate the agreement.

There is also an Addendum that will supersede this statement where if signed, you will wave your right to terminate if the Appraisal amount comes in lower than the agreed upon price.

You will then have to go through with the purchase.

If you are unaware of what you are signing then you need to consult a Real Estate Attorney

If there is are major structural issues or safety hazards in the home

Some homeowners decide to do all of the work themselves, while others prefer to hire a professional. The latter option is often the more cost-effective choice.

What are the benefits of hiring a home inspector?

The biggest benefit of hiring a home inspector is that it saves time and money in the long run. Home inspectors will assess your home on all levels, from structural issues to safety hazards, giving you an accurate assessment of what needs to be fixed right away and what can wait for later.

Normally when you are doing your home inspection the home inspector should instruct you on things such as structural damage and safety hazards.

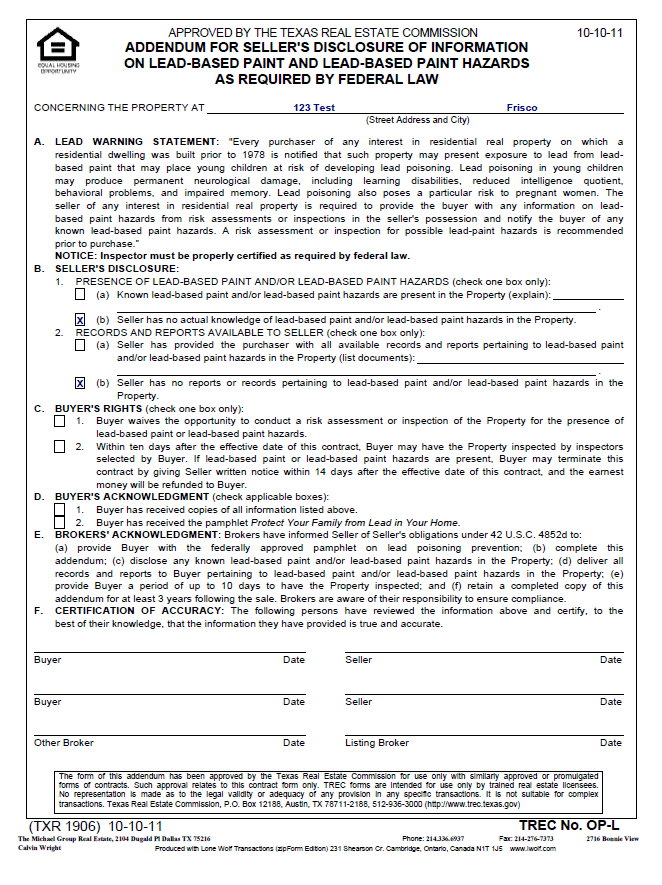

Some things like having lead-based paint or mold in a home can make a difference and these are things that you should catch when you are doing your home inspections.

If for some reason you find that the structure of the home is severally damaged this might make you think about wanting to move forward with the home.

Normally if you feel that there are major issues with the structure you should include an engineer report when you are doing your inspections.

Some Home Inspectors might not be engineers and to get a better feel of the structure an engineer report will be needed.

You would need to call around to find either an engineer or a foundation company. Remember that an engineer report will be superior to having a foundation company report.

On older homes that were built before 1978, there is a Lead Base Paint Addendum that is normally signed.

The seller will normally check off whether or not to their knowledge there is lead-based paint or not.

It is up to you as the buyer to see if you want to go forward with trying to hire someone to check for Lead Base Paint.

Another thing to consider, is when you are buying acres with a home on it, consider whether or not the ponds or the lakes have clean water and also whether or not the water is clear from being dumping sites for hazards materials.

All of this is up to the buyer to make sure that you have all of these different things inspected

If The Neighborhood Has High Crime Rates Or Poor Schools

We often hear the question of whether or not moving to a better neighborhood is worth it.

Moving to a better neighborhood does not guarantee that the child will do better in school.

However, some factors suggest that it can be beneficial for students to live in an environment with better schools and lower crime rates.

This is where you come in. You should do your homework before you make the offer on the home.

If you somehow are unable to do these checks before you make the offer on the home.

Then it would be important to check into this information during your option period on the home. It would be a good idea to check out the school’s ratings online to get a better idea of the schools.

A good source to check out would be schooldigger.com. You can go here to check out the schools.

Here you will see where it gives you information about schools and gives you the average grade of the schools.

This is great when you want to find out information about the schools.

If you are concerned about high crime neighborhoods you can also check the local police department.

When you call the local police department they will give you information on where to go to find out what are the local crime stats for that neighborhood.

You can also drive in the neighborhood before purchasing to see what has been happening in the neighborhood at night.

Another thing you can do is ask some of the neighbors about that neighborhood. Who would know best about the neighborhood than people who live in the neighborhood?

Do understand that nowadays people aren’t as friendly as they use to be but you might find someone who would be willing to let you know about what’s going on in the neighborhood.

Lastly, you can look online for the crime stats. Another website again to consider would be spotcrime.com.

You can go on their website and look to see what has been going on within a zip code.

If for some reason you feel the neighborhood doesn’t meet your expectations you can back out using your option period.

Remember to use the Option Period to back out of the offer.

When you find a better home for less money elsewhere

When you are in a competitive market this might not be possible to find a home for less.

When it’s a seller’s market most of the time the home will be over the asking price or the property will go for over the appraised value.

When you think about finding a better home for less money elsewhere you might have to consider the idea that you might have to buy a home that will need a lot of work.

Those types of deals are normally the house that you will have to repair.

Typically, you will try to do your best to find the properties in your searches and before you make your finalized offer on a property.

But if for some reason if you are under contract with a seller but see a better deal somewhere else.

The only way you will be able to make an offer on the other deal would be to use your option period to terminate the current contract with the seller and then move forward with making an offer on the other deal.

You will lose your option money but you want to lose the earnest money.

You can withdraw your offer during the option period and then proceed with making an offer on a better deal.

The other way this would work would be more in a buyers market.

If the market is shifting to a buyers market then you will see where homes are sitting on the market past a certain amount of Days On Market (DOM).

In a good market, homes will sit only for 30 to 60 days.

No More than 90 days.

When the market is more of a buyers market the days on market will be more around 100 to 180 days on the market.

This is something to pay attention to when you are trying to get homes for less money.

Overall remember the decision is up to you.

You can back out during your Option Period.

When the seller doesn’t negotiate with you on price, terms, or other important factors like closing costs and inspections

There is nothing more frustrating than buying a home and not being able to negotiate with the seller to come up with fair terms.

The seller might not be willing to make concessions. The Seller might not be willing to negotiate on price.

The seller might even want you to wave your inspection period. Or, unwilling to give you help with your closing cost.

These are things in the Real Estate transaction you have to be prepared for.

If for some reason you run across a seller who is unwilling to give you terms on the home then you might make a solid decision to back away from the house right then and there.

You do not want to wait until your Option Period is over to realize that some pipes are leaking and the seller is unwilling to fix it and you checked off “as is” on the agreement.

When this happens you have to be prepared to walk away. If you like the house and find yourself in a bidding war then these are some of the things to consider.

You might check off taking the house as-is, you might wave your inspection you might even tell the seller you’re not asking for seller concession.

All this makes sense if you have checked the home and you see that the home fits your needs.

Make sure you don’t wait until your option period is over to realize that you don’t want to go forward with buying the home.

If you can’t get financing for a mortgage on the property

If for some reason you talk with your lender and find out that you don’t qualify for the loan then this would be another reason to walk away from the house.

When you typically make an offer on a house you will fill out the Third Party Addendum with your Realtor.

The Third-Party Addendum will normally have language in it that if a buyer is unable to qualify for a loan then the earnest money will be returned to the buyer.

This is normally the case in some of the transactions.

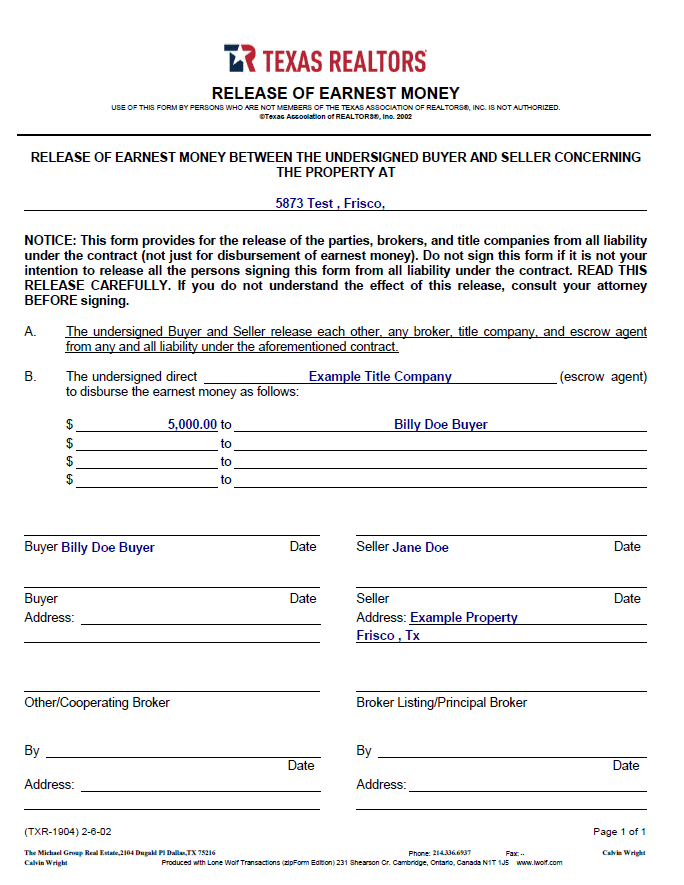

If you find yourself in a transaction where you couldn’t qualify for the loan, typically your agent will send over the letter from the lender showing that you were unable to get approved for the loan.

From there the Realtor will send over a Release of Earnest Money and the earnest money will be returned to the buyer.

Make sure you understand the language in the Third Party Addendum.

If for some reason you don’t understand it you need to consult with a Real Estate Attorney.

There are some possible reasons why a buyer may not qualify for a loan.

Sometimes it’s as simple as not having enough credit history or income, but there might be more to the story.

It could also be because of a lost of job or the buyer might have changed their credit score by going out and buying a new car.

When You’re Feeling Pressured To Buy A House That Doesn’t Feel Like “Home”

Never allow anyone to pressure you into buying a home.

Doesn’t matter who it might be. If it doesn’t feel right then more than like it’s not.

Keep in mind that when you go to closing and you sign on the dotted line.

Your name is the one that will be on the Warranty Deed and the Mortgage Note.

You are the one who will be responsible for making the mortgage payments on the home.

So make sure you understand that you shouldn’t feel pressured to buy a home.

Buying a home is one of the most important decisions you’ll make in your lifetime.

There are many advantages to buying a home, but if you aren’t sure it’s right for you, then you should back out of the deal.

You have to remember that the best time for you to make this decision would be during your Option Period.

When you are in your Option Period you want to take the time to make sure you are ready to move forward with the home buying process.

You want to ensure that you are making this based on what you want to do and not based on being pressured to buy or being pressured to make a sudden decision.

The overall goal is to make sure that you are happy with your home buying decision.

When you go to the closing table and sign on the dotted line you are saying this is my home and I feel good about the decision I made to make this purchase.

If you can truly say that, then you are ready to buy that home and make that home your new place to stay.

Conclusion

There are many reasons why someone would want to walk away from a house.

The price of housing has gone up dramatically in recent years, monthly payments on new mortgages are higher, and finally, there could have been a change in the buyer’s situation that caused them not to be able to close on a home.

I hope this article has been helpful for you.

Whether you’re a first-time homebuyer or an experienced investor, there are a few important things to keep in mind before deciding to buy that house on the market.

The biggest thing is knowing when it’s time to walk away from a property. Let me know if this blog post helped.

Feel free to contact me if you are in the market to buy and sell your next home.