Buying a house is a huge financial undertaking, so it can be a stressful process. So the question is always asked. How to buy a house with no money down?

Even if you have enough money to buy a house, you may not be able to afford to close on the purchase, or you could be waiting for the perfect house to pop up on the market.

Before you take the plunge, make sure you understand all of the costs involved with buying a house.

Buying a home is one of the most exciting and rewarding things you can do as an adult. It’s also one of the biggest financial commitments that many people will ever make in their lifetime.

If you don’t have much money saved up, this commitment may seem daunting and unachievable to you. But there’s no need to fear!

The goal of this blog post is to show different methods for how people can purchase homes with no money down, as well as share with you how it works.

If you’re interested in buying a house but don’t have the cash for a down payment, read on!

What is a No Money Down Home Loan and Am I Eligible?

A no money down home grant or silent loan is a mortgage loan that requires no initial cash from the borrower.

This type of loans are designed for people who have little or no savings and can’t afford a down payment on a house.

No money down home grant or silent loan is typically a loan or grant that is given to a borrower but sits silently on the property as a second lien.

And yes, you are eligible for this type of loan if you meet the qualifications. But make sure to read up on all of the details before applying.

The main thing you have to understand about no money down loans is the money has to come from somewhere. (Read that again)

In a transaction, you will be required to have some type of contribution when it’s time to close.

What this being said you know that you can do something’s to where you will have less expense out of your pocket but you have to remember again it must come from somewhere.

What type of homes loans are considered no money down

When thinking about no money down loans. Currently, two programs offer no money down. VA and USDA.

What is a VA Loan?

VA Loans are popular in the US to help service members and veterans purchase homes. The VA guarantees the loan, which is then fully funded by the Department of Veterans Affairs.

A VA Loan is a type of home loan guaranteed by the Department of Veterans Affairs (VA) to eligible service members, veterans, or military spouses to purchase, build or improve a home in the United States.

VA Loans can only be used on primary residents. Keep this in mind. The down payment is not necessary for those who are eligible. But a person will still have to pay closing cost.

So how can this be used in conjunction with no money down?

In the example, we have Edward who served in Afghanistan and is now looking to buy a home.

Edward is approved for a VA loan and is now ready to own a house in Farmer Branch Texas.

Edward finds a Buyers Agent and he finds a home for $400,000.

He puts an offer in on the home and the Real Estate Agent advised to add seller concession of $8000.

They give the seller the asking price and the seller agreed to pay the seller’s concession of $8000.

This lowered Edward’s closing cost expense. Edward didn’t have to pay a down payment but he had to pay closing cost and adding the seller’s concession helped with the closing cost.

In the above scenario, Edward still has to pay a $24000 closing cost. With the Seller giving him $8000. He now has to only pay $16,000. In closing cost.

How can this be made into a no-money-down deal?

To do this the lender can use a down payment assistant program and a closing cost assistant program. The lender can also offer Edward a lender’s credit.

By using this program the closing cost would be paid creating a no money down.

What is a USDA Loan?

The USDA loan provides affordable financing for rural areas.

USDA loans are federally insured loans that are originated from the U.S. Department of Agriculture, Rural Development (Rural Housing Service). They provide affordable financing for rural areas, including farmland and homes.

When doing a USDA loan there is some limitation to this loan. When you’re doing a USDA loan you have to understand that this loan has location limits. You can’t use this loan everywhere.

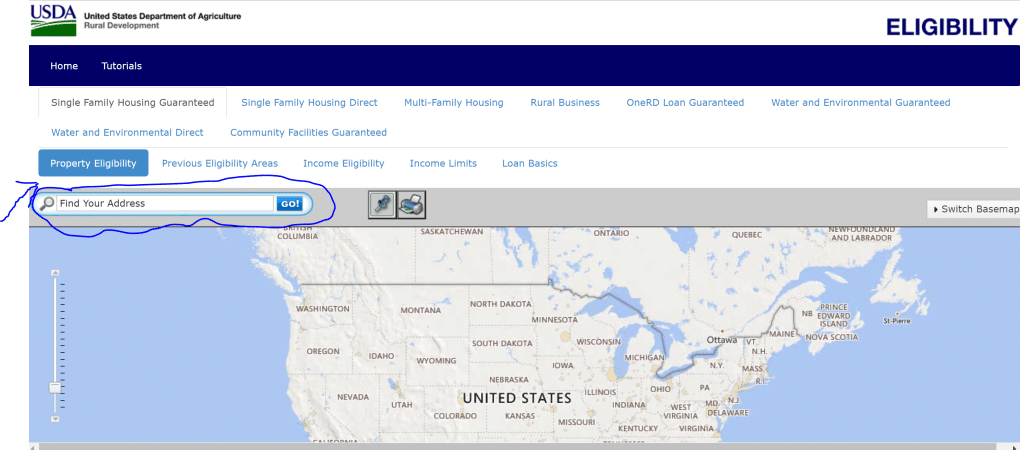

The other thing about this loan is that this loan has an income limitation. To figure out what location can receive the USDA loan you will have to look up the address to find out if the area is eligible for a USDA loan. To find this location you would need to go to USDA website and click eligibility.

Here you would pick what type of property you are looking for. From there you will enter the property address and it will let you know if the address you put in qualifies for USDA.

So how can we create a true no-money-down USDA transaction?

To make this a no money down transaction you would need to cover the closing cost associated with the loan.

For example, you have a home that you want to make an offer fast in Forney Texas.

You discover that the area will go USDA. You make an offer of $350,000 on a house that sits on 3 acres of land.

You find out that the closing cost is $21,000. You can ask the seller for a seller concession of $10,000.

Which would only leave $11,000.00. You could then ask an immediate family to gift you the other $11,000. Which would make this a true no-money-down deal. (More on this later in the article)

The other way to do this would be to use a closing cost or down payment assistance program in conjunction with the USDA program. (More on this later in the article)

What is an FHA Loan?

An FHA loan is a government-backed mortgage that is insured by the U.S Department of Housing and Urban Development (HUD).

FHA loans can be used for purchasing a home, refinancing an existing mortgage, and bridge financing. They offer some of the most competitive rates and flexible terms available on the market today. Unlike other government-backed loans, FHA loans does require a down payment amount as low as 3.5%.

How to create a No Money Down Deal Using FHA?

In order you create a no money down using FHA loans you will need assistance from the following:

- Immediate Family Gift

- Seller’s Concession

- Down payment and closing cost assistance program.

An Example of this would be as following:

You have a seller who needs to sell their house fast in Frisco Texas. The seller is wanting $450,000.

You give the seller their asking price and the seller doesn’t want to give you seller concession.

How can you create a no-money-down?

You can use the down payment assistance program and closing cost that doesn’t come from seller concession.

From there you will give the seller $450,000. And the program would pay your down payment of 3.5% which would be $15,750.00. The closing cost assistant and down payment program will only cover $19,000.

How would we cover the lender closing cost?

You can ask an immediate family to gift you the $27,000.00. This will cover the other closing cost amount. Which creates a no money down.

Where To Get Down Payment Assistance

There are a few different types of down payment assistance programs available to those who qualify. These programs typically offer a loan, grant, or both.

The down payment assistance programs work by providing a lump sum of money to cover the cost of your down payment security deposit.

This lump sum is provided in the form of low interest, government-backed loan that you don’t have to repay until the time you sell your home or leave it as an inheritance.

The money for this type of program is usually given as an interest-free loan that must be paid back with funds from your home equity or through proceeds from selling your home.

The following is a list of down payment assistance programs available.

Seth Down Payment Assistance Program

The purpose of this program is to assist individuals with down payment assistance to help them purchase their first home.

Seth offers 3 types of programs

5 Star Texas Advantage

Goldstar Program

Mortgage Credit Certification

Please note: To use this program you must make sure you a dealing with a lender who is a participant in the program.

Normally a second silent lien is placed on the property and can either be forgiven or is due and payable if you choose to sell your property within a short period.

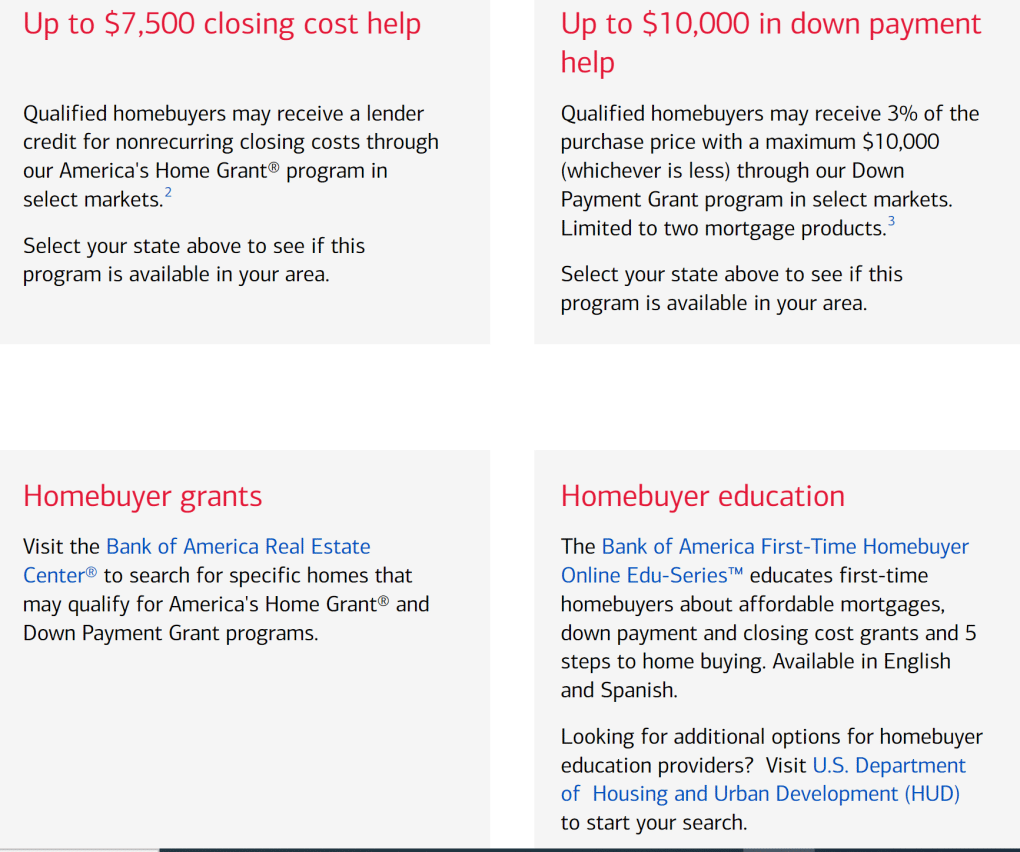

Bank of America Down payment Assistance Program

Bank Of America Down Payment Assistance Program

Bank of America Is Offering A Down Payment Assistance program.

Qualified buyers can receive up to $7500.00 to $10,000.

You will have to contact Bank Of America to find out the areas and the location that these grants are available.

TSAHC Down Payment Assistance Program

The TSAHC program makes a great program to use when you need help with down payment assistance and closing cost. There are no limits on the area you can go to.

If you would like to know more information about TSAHC check out my page about the TSAHC program.

Chase Homebuyer Down Payment Assistance Program

Chase does offer a down payment assistance program. But it would depend on where you live. It’s not offered everywhere.

Their down payment can range from a minimum of $2500.00 and up.

You will have to check your local chase mortgage lender to find out what programs they offer.

What Would Be Alternative To Down Payment Assistance Program

If you want to know an alternative way on how to buy a house with no money down then you would want to ask your mortgage lender about your immediate family gifting you down payment and closing cost.

When you are using this program you will need to make sure you have an immediate family member who has the ability to gift you your down payment and closing cost.

This would be considered Mother, Father, Grandparents, Brother, Sister, Aunt, and Uncle.

Since this is considered a gift this wouldn’t be paid back.

You will need to make sure that if they are going to gift you the down payment and closing cost the funds would need to be transparent.

It means you would have to be able to trace the funds back to an account.

How To Use Credit Cards For Closing Cost Or Down Payment.

If you are thinking about buying an investment property. Another way to purchase a property with no money down would be to use the credit card cash advancement.

To do this you would need to make sure that you have a large cash advancement value.

You would use this method to buy an investment property but you will need to make sure that you are not maxing out your cards to do so and you would need to make sure that you can pay back the amount.

Also, remember that although you are doing a no money down type transaction. The money has to come from somewhere.

Your goal would be to make sure you have credit cards that have low APR interest rates.

If you have a higher APR it can work as well but the monthly payment will be higher than if you had a lower APR.

Please note: This may not work on your primary home sale because it will cause your debt to income to increase and will decrease your credit score. When you are applying for a home loan, as your primary residency, you have to make sure that when the loan file is in underwriting the loan file is the same as when you first applied for the loan. You want to try this only on an investment property that you plan to hold for a short period.

Remember, when you do this the amount still has to be paid back.

Conclusion

I hope you enjoyed my article on how to buy a house with no money down.

My goal was to provide you with the best possible resources that are currently available.

You can use these strategies to help you get into a home with little money as possible.

The key to buying a home with no money down is patience and persistence.

If you’re willing to wait until the perfect opportunity presents itself, then this might be an option for your future home purchase.

This article has provided some helpful tips on how to buy a house without any cash. Let me know if it helped!