What is TSAHC?

TSAHC stands for Texas State Affordable Housing Corporation. It is a non-profit origination. They were created as a statewide affordable housing back in 1994.If you never heard of them.. They are one of the down payment assistance program that is available to help first time home buyers to be able to afford paying the down payment need to buy a home.A lot of times what stops buyers from buying a home is the fact that they don’t have enough money saved up.And in the next few paragraphs we are going to take a look at this program.. This program allows for borrowers to be able to get in a property with little or no money down…The first thing you have to do is understand a little bit more about how these program works. We are going to take a look in detail on how this works.When you do a down payment assistance program, it means that the money for your down-payment has to come from someone. Typically in a transaction, we would normally do the transaction as follows:We have a example home purchase price of 250k. This is the amount that the seller is wanting. We would would make our offer a little over asking price which would be 255k…We would then ask the seller to help with closing cost assistance of 5k which would be given to the buyer for their closing cost.This amount would go on line 12.1B. under Trec real estate contract. We would then put in 5k and send the offer over to the seller.

One of the things to keep in mind, we are in a sellers market. A lot of sellers are not willing to give the buyers a large amount in closing cost.If you are a buyer and you decide to make offers in a sellers market. Understand that the seller may or may not accept line 12.Because its very competitive and offers are getting accept over asking. Sellers have no incentive to give buyers a lot of money to close unless the property needs a lot of work or unless there is issues going on in reference to selling their property.So if the sellers aren’t willing to give you money, but you need money to close, then how do we make this deal work?This is were you bring in the program TSAHC. The reason why is because this program does not use funds from the seller.

How Does It Work?

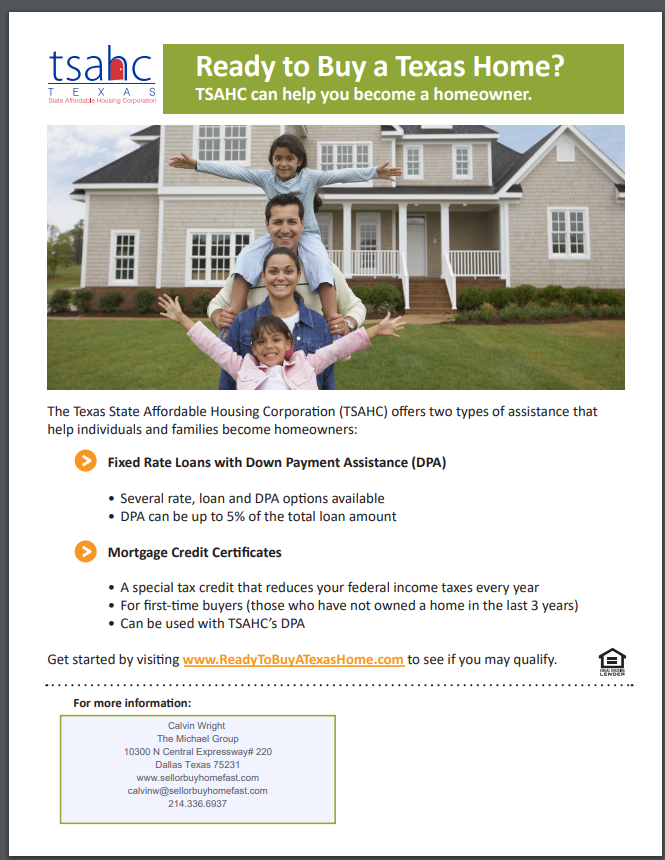

The way that TSAHC work is simple… When an offer is made, the offer is made like a normal offer. In the above example the seller wanted 250k for the home.. As your agent I would make the same offer of 250k…We would then get with the lender to get your approval letter. Then we would send over the offer… You would close on your property.The down payment amount will be coming from TSAHC. The seller will net exactly what they want without having to give you seller concession, you would be able to close on the property and live in your dream home…Based of what TSAHC says there are 2 types of program..

The first down-payment program they offer is like a grant… If you apply and you are eligible to receive the grant .The grant works as following: When you are approved for the grant in order for it to be a true grant you most live in the property for 6 months. So you most make sure you understand this part..If for some reason you move before the 6 month the amount is due an payable when you sell the property. You credit score will need to be around +620. (Re-Read That part again)The Second way to do little or no money down would be a second lien on the property. There would be a 1st mortgage lien which would be who you will pay your mortgage to. Then you would have a 2nd lien holder which would be TSAHC.Understand that the TSAHC program would be consider a second soft lien. There would be no interest on the amount.There would be no month payment on the amount. This amount would stay on the property until you decide to sell the property, transfer the property or when you refinance the property.To use this Second lien program you do not have to be a first time home buyer. Down payment amount can be up to 6%. But you must have a +680 credit score to be able to apply for the second lien program. (Re-Read This Part Again)What kind of interest rate should I look for when applying for a program like this?Keep in mind that when you are applying for these types of programs the interest rate might be slightly higher then just simply paying your own closing cost.Understand that you are using OPM (Other Peoples Money) to get your down payment done. So you have to understand this part that there is a possibility that the interest is going to be slightly higher.If you feel that you do not want to deal with a possibility of a slightly higher interest rate, then you will need to just bring your own funds to closing.But, if you understand and feel that you can benefit from using the down payment assistant program then you can move forward with qualifying to receive this program.Remember you must use a Lender who is TSAHC certified..

Remember that if you are going to use this program. You have to use a lender who is TSAHC certified.If you need help with this feel free to contact me if you are in the Dallas FT Worth area and I can assist you with this.If are not in this area then visit there website and click on find lender... And you can locate a lender that is close to you as well.

Mortgage Credits Certification

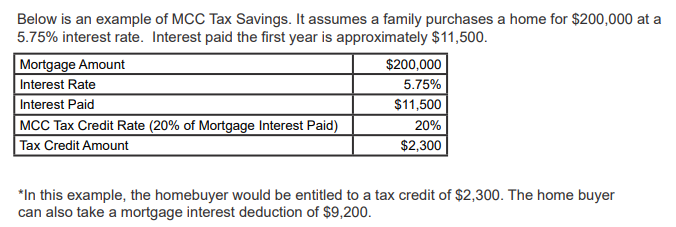

Based of this program you can also add a Mortgage Credit Certification. The main benefit of the tax credit is being able to reduce your federal Income Tax.In order for you to be eligible for this you must be a first time home buyer or not owned a home within the last three years.The following example below gives you a idea of how the Mortgage Credit would work.