A person that is retired may have taken out a reverse mortgage on their home to give themselves some extra income each month.

The reverse mortgage can make sense when the person who is taking it out is single or doesn’t have to worry about passing the property down to heirs.

Some things needs to be understood about reverse mortgages. Reverse mortgages can be a source of income for someone who has retired or who for some reason is lacking monthly income and needs a boost in income.

The thing to keep in mind about a reverse mortgage is that upon the person death, the reverse mortgage then becomes due and payable.

There are times when a reverse mortgage is taken out and the property doesn’t have enough value in the property to sell the property in a normal sell.

When this happens I want you to know that it is still possible to sell the home with a reverse mortgage if the property has little or no equity.

A short sale is an option to sell the home when the home has a reverse mortgage and no equity. Keep in mind that every lender is different.

But what we are going to do is take a look at a way to get your home sold on a short sale when there is a reverse mortgage in place.

What is a Reverse Mortgage

Before we get started in understanding on how to sale your home with a reverse mortgage using a short sale, we want to understand more about what is a reverse mortgage. The reverse mortgage is a non recourse loan.

This means a lender cannot go after the borrower for any money owed on the home . A reverse mortgage is a loan that allows borrowers to withdraw a portion of their home equity.

As the name implies, a reverse mortgage is largely a loan in reverse.

Rather than a Homeowner creating payments to his or her mortgage, the mortgagor pays the homeowner.

The amount a homeowner receives should then be repaid once the homeowner passes away, sells the house, or isn’t any longer living within the home.

Due to the nature of these loans, it is not surprising that so many people are asking, “What is a reverse mortgage?”

What is a Short Sale

To understand short sales, also known as short payoffs and pre-foreclosure sales, we must first describe the meaning of “short sale”.

A “short sale” is defined as the negotiation of the transfer of ownership of real property with a Mortgagee (lender), also known as the beneficiary, when the property is financed.

Short sales occur more often in markets where REO properties are abundant.

So it means the lender is willing to take less than what is owed for the mortgage.

So if for some reason the property is valued at $200,000 and someone took out a reverse mortgage of $198,000.

Then it would mean that there is possible not enough room to pay a Realtor and even pay closing cost to pay back the lender.

This is were a short sale would come in hand. If you need assistance with getting your home listed on short sale and you have a reverse mortgage contact me.

The goal is to make sure that the lender can recoup most of there money back. The lender will make some money or recover their money on the home then take a loss.

They may approve the short sale for this reason.

This will allow the senior to be in a better position with the lender.

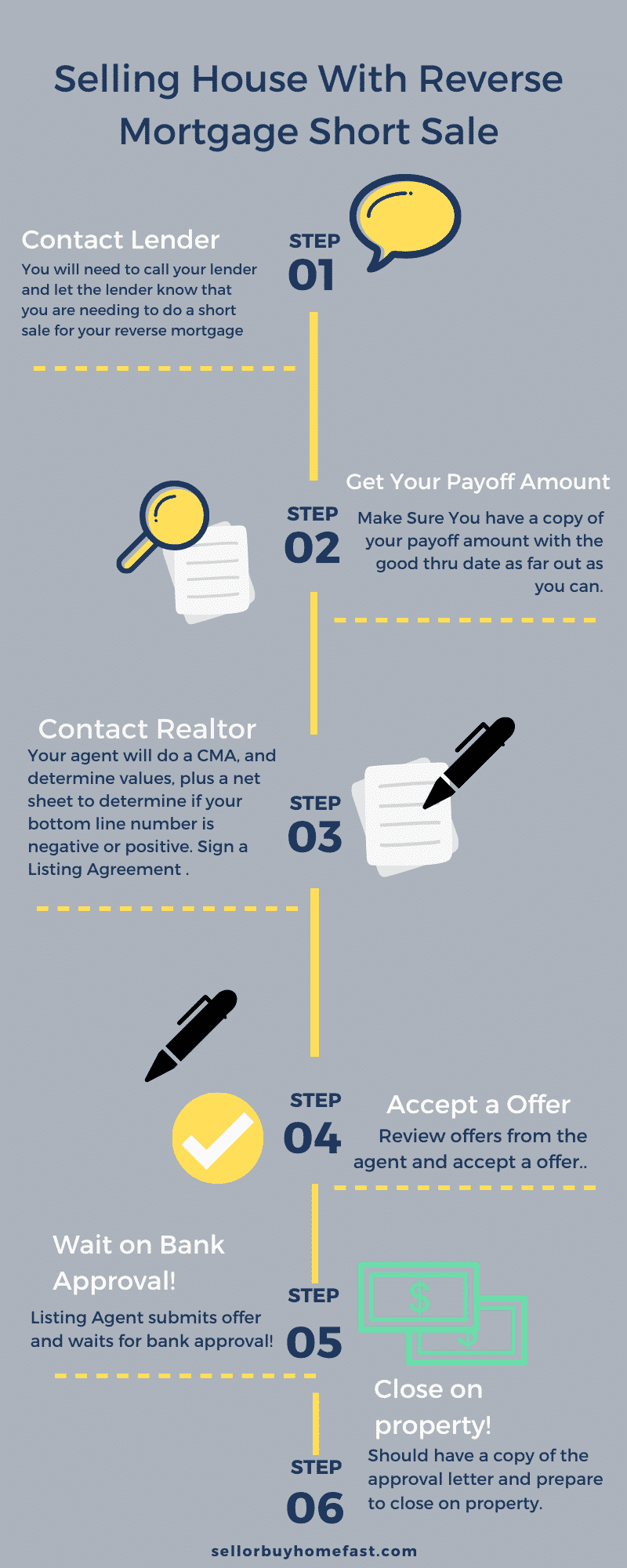

Getting Started

To get started with this process. You are going to need some information about the values of the property.

You will need to do some research or you can contact your Real Estate Agent who you wouldn’t mind possible listing the property with.

When you contact the Agent let the agent know that you are thinking about listing the property and the property has a reverse mortgage on it.

The Realtor will then need to do a Market Analysis. The Market Analysis will give you values of what the homes are selling in the area.

Go over the values with the Agent to see what would be the average home price in that area. Once you know what the average home values are you can then move to the next step.

Get A Payoff Amount

Your next move would be to get a payoff amount from the reverse mortgage lender. You want to make the good thru date for as long as you can.

The payoff amount gives you all information on what the fees and the mortgage amount needs to be paid back.

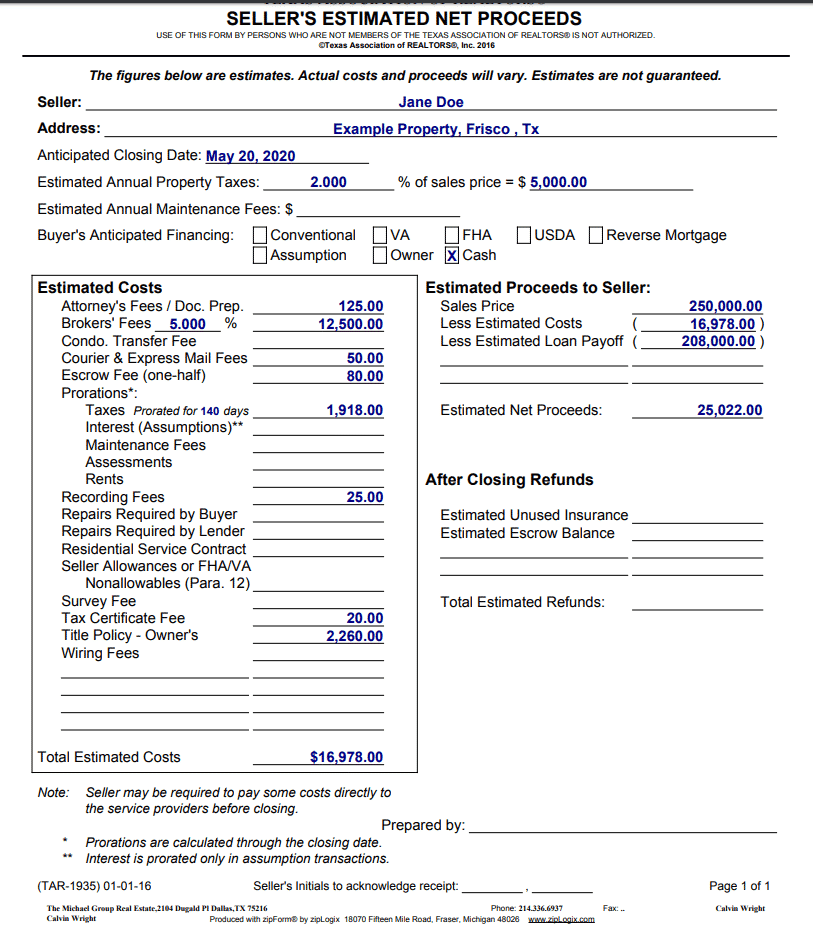

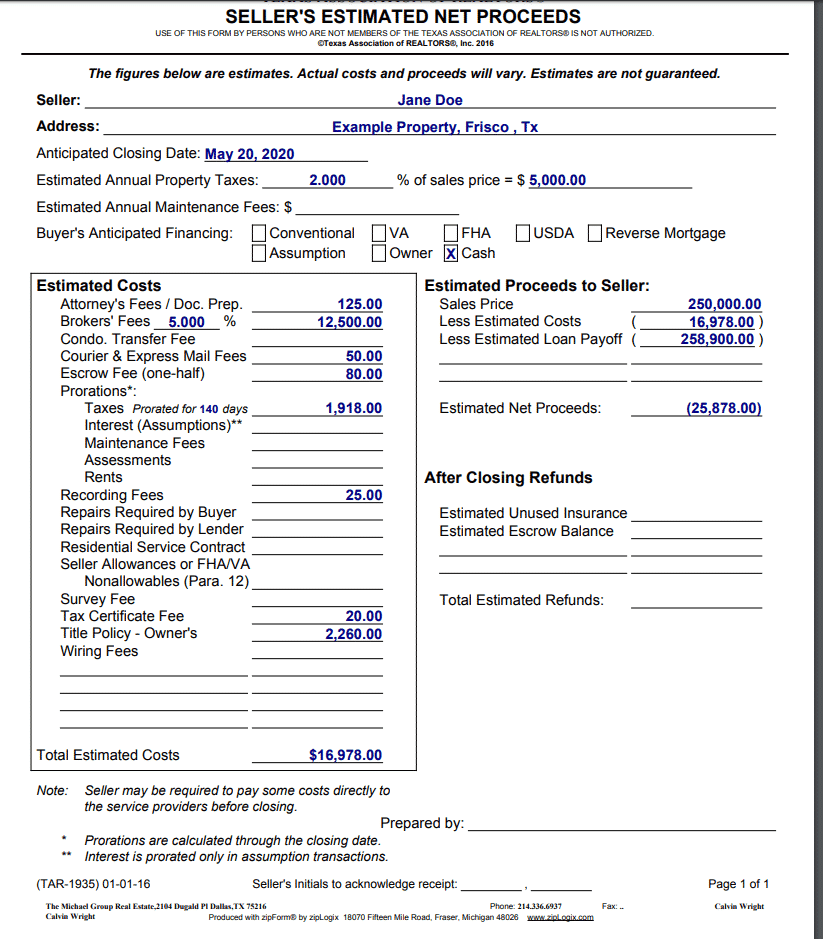

When you have this number. You will need to contact the Realtor back and see if the agent can put together a net sheet.

The net sheet is going to show you your expenses and then it is going to show you the amount that will be left after the expense.

If the bottom number shows a negative this will be the amount you need to sell the property. It is the amount that you will need to bring to the table.

For example. If we have a house and it sold for 250,000 and you look on the net sheet and see the amount showing on the net sheet to be 225,000.00 the net amount left would be $25,000.

This is the amount that you will keep in your pocket after all expenses are paid. If the Realtor Hands You a net sheet and the amount shows to be a -25,000.00 after all-expense paid.

You would have to bring 25,000 to the table to close on the home.

This is where a short sale would be necessary to clear out the debt and then it keeps you from bringing that amount to closing.

Working with the Lenders

When you are working with a lender you are going to now need to call the lender up and let the lender know that you are needing to sell the property.

You know that it has a reverse mortgage on the home but you are wanting to do a short sale on the property because the amount is more than what is owed on the property.

If the homeowner is deceased you will need to provide the necessary document of the probated will or you will need to show the lender that you are the person that can make the decision on behalf of the decease person.

If you are the homeowner and you are no longer living in the property or you have moved to assistance living or you moved out and still have a reverse mortgage on the home then you will need to make sure that you give authorization to the Realtor so that the Realtor can contact your mortgage company and get the necessary Short Sale packet.

This packed will be a list of things that the lender is going to need to do the short sale. Make sure you keep the check-list that the lender gives you.

Make sure you check off items once you have completed the check-list from the lender.

Short Sale Guidelines

Even when working with a reverse mortgage client there are some guidelines for a short sale.

These guidelines were developed by the U.S Department of Housing and Urban Development.

They will allow the lender to look at the qualification for a short sale and see if the requirements are met.

According to the guidelines there closing costs need to be reasonable and they will be paid by any money that the mortgagor makes off of the sale.

The commissions from a real estate agent must also be filled during the short sale.

The agent still wants to get paid and needs to get paid for their work. Keep in mind that every lender(s) guidelines are different and they may vary from state to state.

Working with Realtor

Now that you have your payoff and you should have your short sale packed from the bank. You want to contact your Realtor.

The reason for this is you will need to make sure that you have a Listing Agreement in place that will show the Listing Price for the house and the amount for the commission.

Remember, that commissions are negotiable. This will be between you and the Realtor to discuss what the commission would be.

When you are trying to do a short sale the bank will require that the property be listed with a realtor.

The realtor will show the home and will help with the paperwork.

They will need to have an Authorization letter signed so that they can speak with the mortgage company and all mortgage-related documents can be shared with them.

They will need to also be able to discuss the file with the lender as well as be able to present offers to the lender on your behalf.

Once the Listing Agreement is signed then the Realtor will prepare the home for the market. They will use the CMA( Comparable Market Analysis.)

This information will be used to help determine a selling price for the home. The selling price should at least cover the debt that is owed on the home and the closing costs that are associated with the home.

The real estate agent will then show the home and they will get offers on the home. These offers are then taken to the lender and if accepted the closing process will begin.

The buyer will need to get the mortgage and the closing process will need to be completed. In some cases, the borrower may be given a cash offer for the home and they will need to look at this.

In some cases, the house will sell for less money than is owed on it and in other cases the owner will be able to walk away with a little bit of a profit too.

Offer Accepted

Once you have placed the home on the market for sale. You will then be shown offers from the agent.

Your goal is to pick the best possible offer to present to the bank for the short sale. For example, you have a cash offer for the home of 185k.

But you have a financed offer of 200k. Which one do you choose? This will all depend upon if the financed has been truly verified as pre-approved or approved.

Your agent will have to go through the process of verifying the funds of each offer. From there you will have to make the decision on which one you would choose.

Keep in mind that you still on the home. So it’s up to you to choose what offer would best be given to the bank.

Once you have made your decision then you will sign the offer and the short sale addendum.

Waiting on Bank approval

After you have signed the offer your agent will then present this offer to the bank. Keep in mind that the bank can take anywhere from 30 days up to 3 months.

This is why it’s important that when the buyer signs the offer.

The buyer signs the short sale addendum understanding that the waiting process could take a while.

There is no way to determine if you can get an approval quickly. You will just have to wait and allow the bank to send the offer to the investor for approval.

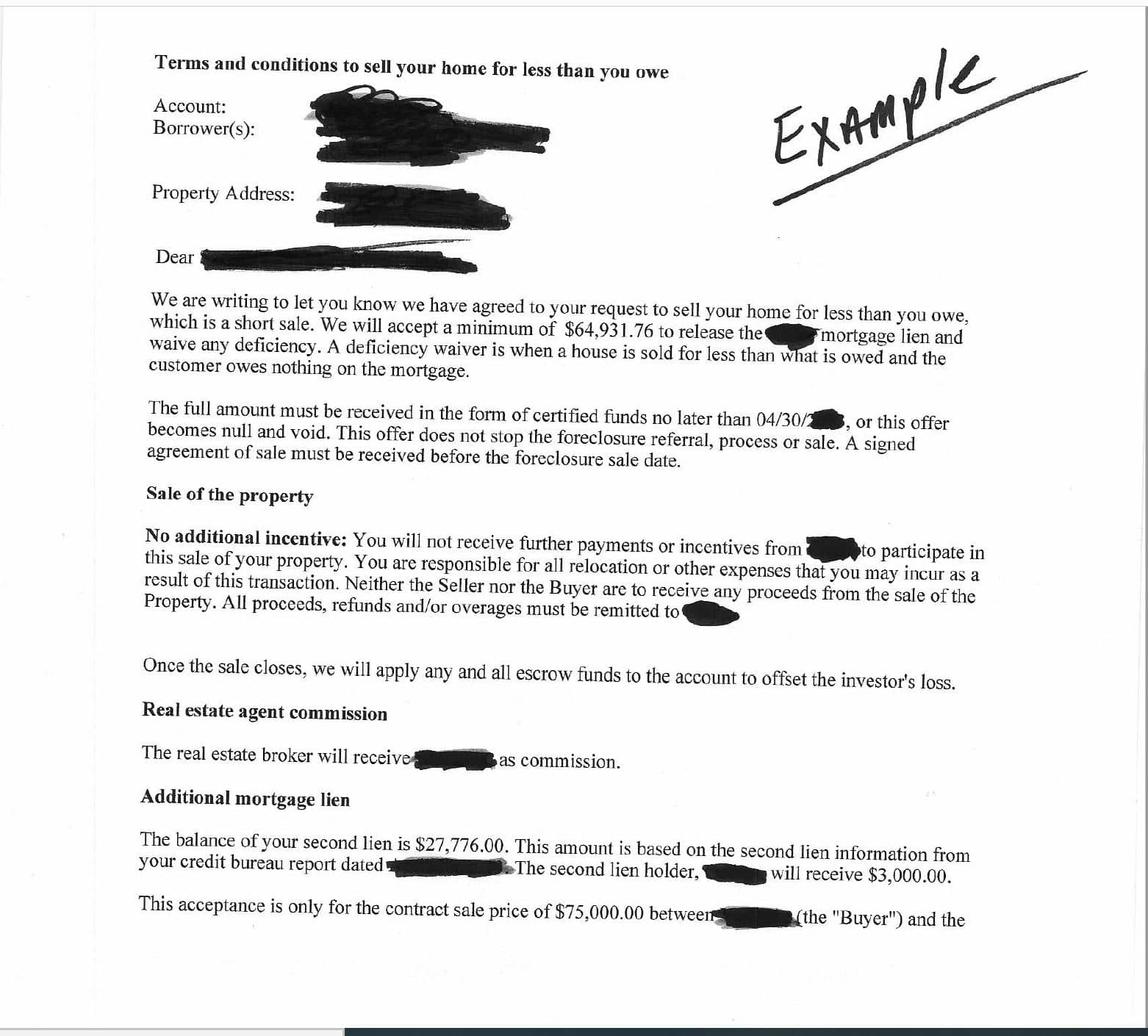

Once the offer goes to the investor for approval. You will receive a bank approval letter. This is very important, you do not have a completed short sale without the bank approved letter.

This letter will have your account number on it and then it will have the amount that the bank is willing to accept for the offer.

If you do not have this letter then you do not have a short sale approval. Please keep this in mind. You have to have the approval letter before you can close on the property.

Closing the property

Once you have the letter of approval you are ready to close on the property.

When you close on the property you have to understand that there is a window of time before the approval letter for the short sale is no good or you would have to go back to the bank and get an extension.

This is why you want to make sure that you have all the necessary things before you receive the letter.

Once you have the letter you have to make sure that your title work is done. You want to make sure that you have the HOA information if this applies.

Have all of this beforehand will help with speeding up the closing process.

Of course, if it is a cash offer you want to have to wait until you receive lender approval from the buyer’s lender.

If you choose to deal with a buyer who is getting a loan you have to make sure that the buyer agent or buyer understands that you are on a time limit.

This ensures that the property closes on time. Your goal is to make sure that everything is ready for closing so that you can close on your home in time.

Conclusion:

Even with a reverse mortgage, a person can still sell their home. There are additional guidelines they will need to follow.

With all the paperwork completed and all documentation sent to the lender, a senior may be approved for a short sale even with the reverse mortgage.

Your next step is to contact me if you have questions or need assistance and you live in the Dallas, Forth Worth, Frisco or Plano area.