If you’re a homeowner and your home is in foreclosure, it can be difficult to know what steps to take.

Foreclosure has many different stages which can vary depending on the state that you live in.

Foreclosure starts with a notice of default from the bank or lender to the homeowner following missed payments.

After this point, there are five possible scenarios: Loan Modification, Short Sale, Deed In Lieu of Foreclosure, Bankruptcy, and being foreclosed on.

Loan Modification is the process of taking all the owed amount and recasting the loan.

When a loan is recast the loan is restructured.

What this means is that missed payments are put to the end of the loan, the interest rate can be modified, and also the monthly payments.

This is currently close to Forbearance Plans but the difference is in a Loan Modification the note can be restructured.

A short sale is when the property owner sells their house for less than they owe on their mortgage and any other liens against it.

To complete a short sale you would need to list the property with a Real Estate Agent.

Bankruptcy (chapter 13) normally gives a chance to restructure. Note: that if you choose to go this route it will stop the foreclosure sale, but you have to remember to make all of the restructuring payments.

If you miss the restructure payments you will find yourself right back into foreclosure.

The Deed In Lieu is when you decide to deed the property over to the bank and allow the bank to take the property before going thru a foreclosure sale.

The foreclosure process is a long and drawn-out process. It’s important to know how long before an eviction would start so you can plan accordingly.

1. What is foreclosure

The word “foreclosure” can be defined as the legal process of selling a property to get rid of it due to a homeowner defaulting on a mortgage note.

Foreclosure happens because a homeowner can no longer make mortgage payments.

How long does it take before a mortgage company decides to places the property up for sale?

This can depend upon the bank and state laws. In some cases, a mortgage company will send out a notice of default even when a property is a few months behind.

If you are in the State of Texas this can happen the moment one payment is late.Once a notice of default letter is sent to you.

The bank will file a Substitute of Trustee which will have the date of the sale listed on it. If you live in the State of Texas a foreclosure can happen very quickly and you can’t delay time on your decision making to do something about it.

If the default amount is not met. The mortgage company will send the property to the foreclosure sale.

This is when the mortgage company sends the house to the foreclosure sale and sells the property at the courthouse steps. You would normally have a trustee appointed by the bank and the trustee would start the bidding process.

2. How long does it take for a house to go into foreclosure

This is the question that is on your mind. How long does it really take for a bank to file a foreclosure? This will vary from state to state. Each state is different, and you would need to talk to a Real Estate attorney about the laws of your state. If you do, not have access to a Real Estate attorney. Then you will need to pay attention to the letters that the mortgage company sends you.

Typically, a lender will try their best to work with you to try to help you stay in your home. This process is the forbearance plans and loan modification. If for some reason you no longer qualify for a loan modification. Then you would have to decide to sell the house on a short sale or outright sell the property.

This is when you contact me. Because I can help with this process of helping you sell your home on a short sale or list your property for sale. If you have equity in your home. Then it is better to sell the property collect the amount minus what you owe. When you clear the debt out. The credit report is going to show a negative report for all the times you didn’t pay. When the property is sold the debt is completely paid in full which will help your credit score over time.

If you are doing a short sale. Your credit will still look bad but remember over time the credit will get better.

Foreclosures can happen within a few months of default or it can take more than a few months before the lender decides to foreclosure. If you haven’t paid your mortgage and you do not qualify for loan modification then you would need to list the property for sale. Sale the property and clear out the underline debit.

Remember, to pay attention to your monthly statements. And pay close attention when you see a Notice Of Default letter. The moment you receive it, this is a key indication that you are headed towards foreclosure.

Again, the length of time can sometimes start at 3 months in default. In some cases, it can start even when you are one month in default. Or it can be a few months in default. Each underline investor is different when it comes to when they can foreclose. And you have to go off your state laws about mortgage loan default.

3. What are the signs that a house has gone into foreclosure

So what are the signs that a home is in foreclosure? When you take a look at Texas Property Code Chapter 51

“Substitute trustee” means a person appointed by the current mortgagee or mortgage servicer under the terms of the security instrument to exercise the power of sale.

“Trustee” means a person or persons authorized to exercise the power of sale under the terms of a security instrument following Section 51.0074.

This document will be filed in the records of your local place where the records are filed. When there is a Substitute Trustee filed in the State of Texas this is the indication that a home is headed into foreclosure.

Another sign to pay attention to are the lender demand letters. Normally the lender will start to send more demand letters. The phone calls from the lender will increase. And you will receive the Notice to Accelerate your loan.

4. When can I be evicted from my home if it’s in foreclosure

The eviction process will not start until after the property has gone to the courthouse steps. If you are in a situation where you have no money then it might be in your interest to stay as long as you can until after you receive a letter or notice that the property has been foreclosed on.

Typically a lender will first take the property thru the foreclosure process. Based on Texas Property Code Chapter 51.

This happens when a public sale at auction is held between 10 a.m. and 4 p.m. on the first Tuesday of a month.

Once the property is then auctioned off. When the property is auction offed there is a possibility that someone new has purchased the property.

At the steps of the courthouse, they are issued a Trustee Deed and they are now the new owners of the property.

When a new owner takes possession. The new owner will send a letter notifying you that they are the new owner of the property. They might even knock on your door letting you know that they have taken possession of the property. Sometimes they will give you time to move out or they will start the eviction process.

If the lender takes possession of the property. The property is assigned to a Real Estate Agent. When the property is assigned, the Real Estate Agent will do a 48-hour Occupancy check. This lets the lender know that someone is still living in the property.

Once the property has been identified as someone still living in the property. The lender is sent the name and information of the person still staying in the property.

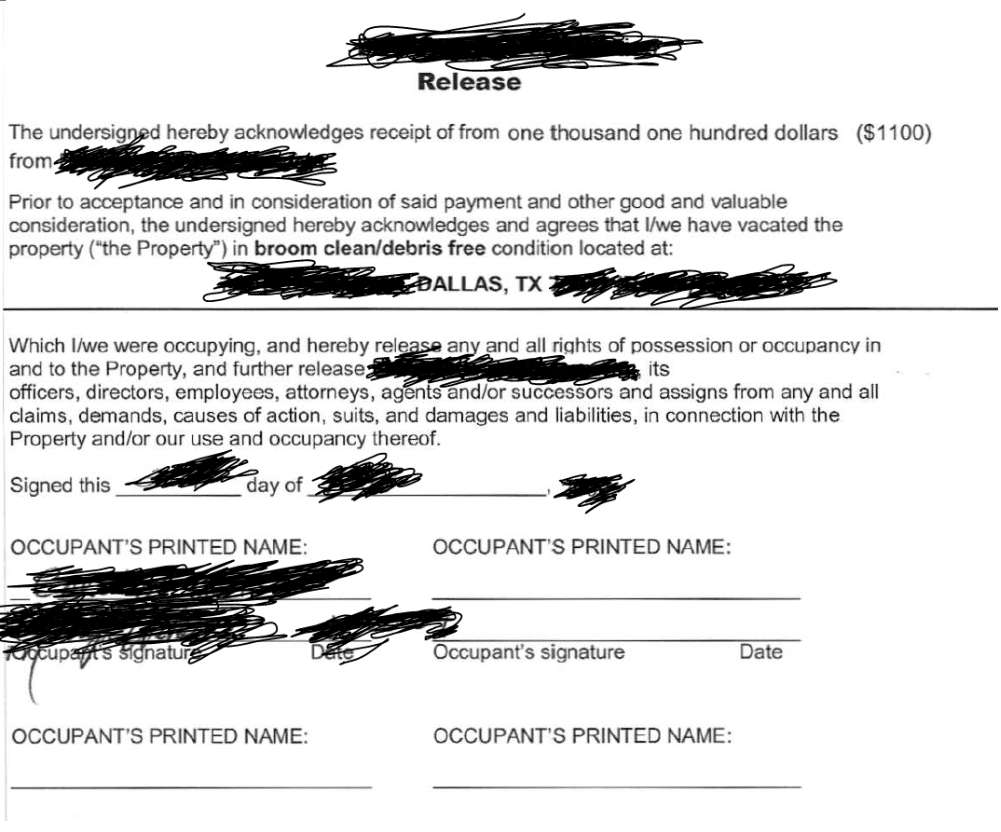

From there the lender will then offer cash for keys to the person who is still there. Cash for keys allows the person to have moving expenses to be able to move somewhere else.

The occupant would have to make sure they remove all personal items and they would be responsible for cleaning the house. Once the agent has checked to ensure the owners have cleaned the house out completely, there is a document that will be signed by the homeowner or occupant. From there a check is then released to the occupant.

5. What happens if I’m renting the property and the Landlord is in foreclosure.

If you are renting a property and you have discovered that the Landlord has defaulted on the mortgage and is now facing foreclosure you would need to contact your Landlord and let them know that you know they are in foreclosure.

You would then have to make sure you let them know that you are stopping the rent payments based on there breach of agreement.

You will need to read your lease agreement and see what the lease agreement says about when the Landlord breaches their agreement.

Each state is different and you will need to talk to a Real Estate attorney about the laws in your state in regards to when a Landlord is in default of a lease agreement.

If you found out after the fact and you are now receiving a letter from a new owner or you receive information that the bank is now the owner of the property.

You would need to make sure you are speaking with the person who is representing the new owner.

It might be possible that the new owner is willing to lease the property to you under a new lease agreement.

If that is not possible and they are selling the home. You can find out how much time they are willing to give you before they start the eviction process. If the new owner is a bank, you see if the bank is willing to offer you cash for keys.

6. Steps you should take before moving out of your rental property once it’s been foreclosed on by the bank or mortgage company

1. Make sure you have copies of all your paperwork including your payments.

2. Make sure any outstanding debts with landlords have been settled and stop payments to Landlord.

3. Make sure you have keys, access cards, and garage remotes to turn in.

4. Do not damage the property. Make sure you keep the property in the same shape you did when you moved into the property.

5. Make sure you know who the contact person is and ask for proof if needed.

6. Make sure you keep the property clean.

Conclusion:

The eviction process can be avoided. But, you have to make sure that you are doing the correct steps to prevent yourself from being evicted after a foreclosure.

Although it might seem like it’s a long and rough road. There is still hope in getting through a hard situation.

Hopefully, this article has given you a better understanding of what to expect when you are faced with a difficult situation.

If you are facing foreclosure and you need some assistance I’m just one call away.

Feel free to contact me with your questions and concerns that may arise during this difficult situation. We would love to answer them for you!