To many people, the thought of making a mortgage payment isn’t glamorous or exciting, but the fact of the matter is that it’s an important step in the life of a homeowner.

So When Do You Make Your First Mortgage Payment?

Mortgages are a big commitment, but they can be an excellent way to build equity in your home.

There is usually a grace period between when you finalize the purchase of your new house and when you have to make that first mortgage payment.

This can give you some time to settle into your new place before having to start paying for it every month.

However, if you’re not sure how long this grace period lasts or what happens after it ends, keep reading!

We’ll explore these questions as well as others that might come up during this process. You don’t want any surprises once that first payment comes due!

The Process of Mortgage Payments and When You Should Start Paying Them

Buying a home is one of the costliest decisions we can make in life. And when you think about paying the mortgage it is a process in which a large sum of money is paid overtime.

We need to also consider other costs such as maintenance, repairs, and other expenses that may come up.

A mortgage is a loan that helps you buy or build your equity in a home or other real estate property.

In the US, a mortgage is a loan used to buy a house or property.

It is typically paid back over a fixed period. Between 15 to 30 years, but it may be paid off sooner if the borrower chooses to pay something on the principal balance each month.

When you schedule a mortgage payment, this is a process of paying back your monthly mortgage amount.

Typically, when you close on your home, in previous years the mortgage company would send you this monthly payment booklet and you would tear the paystub out of the booklet and send in your check with your payment.

Now things are more electronic. You would receive your statement via mail or email and from there you could either mail in a payment, pay it over the phone or pay it online.

The best way to figure out your mortgage payment would be to call your mortgage company and let them tell you when your first payment will start.

The moment that you close on your house expect to pay the payment the next month.

How to Calculate a Mortgage Payment

Calculating a mortgage payment is a relatively simple process that anyone can do. The monthly mortgage payments depend on the loan amount, interest rates, and the number of years for which you borrow the money.

We will show you how to calculate a monthly mortgage payment, including the total cost of the home, down payment, interest rate, and more.

To calculate a monthly mortgage payment, we need to know a few pieces of information:

The total cost of home – price of the house or condo.

Downpayment – the percentage of the purchase price that is paid upfront in cash.

Interest Rate – annual interest rate for this type of loan.

Yearly Insurance – How much the Insurance is on a yearly bases.

Number of Years – total number of years your financing the home for.

Yearly Taxes – this would be the Annual Tax amount.

HOA – if you are paying HOA you need to factor in what that amount will be.

The easiest and the simplest way to calculate your payment is to use an online mortgage calculator.

Remember, that some online calculators do not factor in your yearly insurance and your yearly taxes. If you would like to try ours you can go to our mortgage calculator section.

If they don’t you can easily find out the amounts of these by multiplying it by 12 months.

For example, if your yearly insurance cost you $3,500.00 when you multiply this by 12 months your monthly payment will be $291.66.

If your yearly taxes cost you $6,500 a year. You would multiply this by 12 months, then your monthly taxes expense would be $541.66.

Make sure you factor in your PMI(private mortgage insurance) expense.

HOA expenses are paid either monthly, semi quarterly or yearly. So this is also an expense that you can factor in.

The Difference between Interest Rate and Annual Percentage Rate

APR is the cost of borrowing expressed as an annualized rate, and IRR is the cost of borrowing expressed as a percentage.

APR includes fees and other costs associated with borrowing, but IRR does not.

It’s easy to confuse APR and IRR because they are both interest rates. However, they are not the same.

The difference between APR and IRR can be understood by understanding their formulas.

APR is the cost of borrowing expressed as an annualized rate, and IRR is the cost of borrowing expressed as a percentage.

APR includes fees and other costs associated with borrowing, but IRR does not.

Interest rates are a percentage or a decimal figure that is paid in addition to the principal amount.

They also determine how much you earn on an investment. The interest rate is usually calculated annually and is expressed as a percentage of the principal amount.

Annual Percentage Rate (APR) is a percentage that reflects how much it will cost you to borrow money from an institution over one year for use in purchasing goods or services.

APR includes all forms of fees including origination fees, processing fees, closing costs, etc.

The reason why so many people want to get the lowest interest rate possible is that over time it saves a borrower money.

The higher the interest rate the higher the yield on the loan. This means that you will pay more money for 15 to 30 years.

The interest rate is based on your credit score. If you have a lower credit score then your interest rate is going to be higher.

If you have a very high credit score that would mean that your interest rate would be lower.

Interest-Only vs. Fully Amortized Mortgages

Have you ever considered the difference between an Interest-Only mortgage and a Fully Amortized one? Let’s take a look at their features, benefits, differences.

Fully Amortized Mortgages

Fully amortized mortgages require one to make monthly payments on both the interest and the principal amount, with the principal amount increasing over time.

These types of mortgages are good for people with predictable income streams or those who can afford larger monthly payments.

A fully amortizing loan pays off all interest over time while still allowing for regular monthly payments that are smaller than what would be required to pay off the debt in a full year.

Interest-Only Mortgages

Interest-only mortgages are loans in which the monthly payment consists only of interest.

This type of mortgage is ideal for people who plan to move or refinance their loan before it’s time to start making payments on the principal balance.

Interest-only mortgages are best for clients that have a low income or high debt, but it makes sense to go with a fully amortized mortgage if you are sure about your income.

Interest-only mortgages are popular for accounting for higher interest rates by paying only the interest instead of paying off both the principal and the interest.

This is beneficial to those who have high levels of debt or low incomes, as they don’t have to worry about their finances as much.

However, these types of loans may not be best for clients who are sure about their incomes. This is because they will end up paying more in interest over time which can cause problems down the line.

If you’re new to making mortgage payments and you recently closed on your home, your mortgage should be a fully amortized mortgage loan.

Interest-only mortgages are best used when you are doing investment properties such as flip deals.

These are properties where you plan to only hold the property short term.

The Effect Of The Monthly Payment Date On Your Monthly Payments

It’s important to consider when setting up your monthly payment. In general, this will depend on how you receive your income.

Sometimes it is a good idea to plan out the mortgage payment dates. But typically this date is normally set at the time of closing.

For example, if you closed on your house around the 15th day of the month then that is when the mortgage note was created.

The mortgage note creation date is normally the date that your mortgage payment will be due.

A lot of the mortgage notes typically set their due date to be towards the beginning of the month.

If you think that you need more time, ask the loan officer about the start update of when your monthly payment will begin.

Remember, this will need to be set up at the very beginning. More than likely most mortgage companies will not move the date the monthly payment is due.

You will typically get a grace period to pay the mortgage. If for some reason you go past the grace period there will be a late fee added on the mortgage payment.

If for some reason you find yourself needing to pay the mortgage late remember that most loan companies report to the credit bureau that your payment is late if you pay past that month.

Note: Make sure you consult with your mortgage company about how they report to the credit bureau.

Why it’s Beneficial to Make Additional Payments To Your Principal Each Month

When you are making mortgage payments you might want to think about adding one additional amount to go towards the principal.

You will be surprised that in the long run when you work to pay a little extra on the principal amount of the mortgage it will help to decrease your overall mortgage amount.

A good amount to start with would be somewhere around $50.00 to $100.00 over your monthly payment.

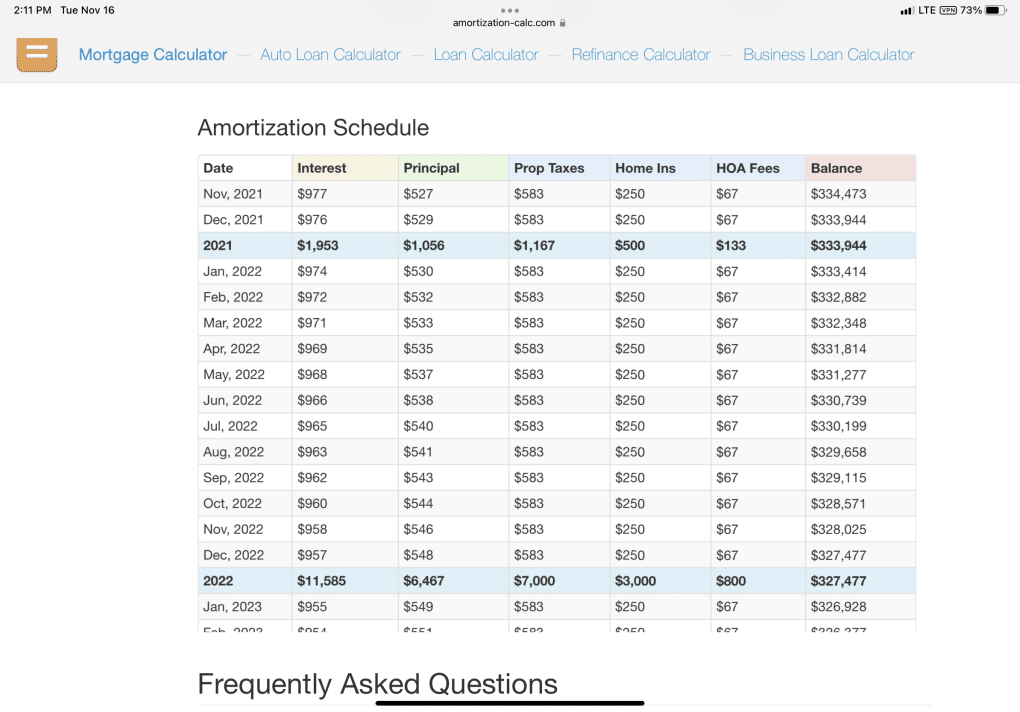

For example, if you purchased your home for $345,000. And you put a down payment of $10,000.00.

Your yearly taxes is $7,000. Home Insurance is $3000. And HOA is $800. Your monthly payment would be around $2,404.30.

This is Taxes and Insurance included. Without the taxes and insurance, your monthly payment will be $1,504.30.

If these payments started in November, it would look like this:

Amount going to interest is $900.00. Amount going to principal would be $527.00 Then the rest would go towards your taxes and insurance etc.

When you add $100.00 to your principal balance you would be paying an additional $1,200.00 that would be deducted from the principal balance.

The benefit of doing it, you are working to pay off the balance earlier vs paying it the full 30 years.

Conclusion

We know sometimes the terms used in real estate can be confusing and it seems like no one knows what to tell you!

Hopefully, this article has cleared up some of the issues that you might have about understanding when to make your first mortgage payment.

As well as some other helpful tips regarding mortgages and making your payment.

Have any other questions? Let me know by contacting me.