It is important to realize that a short sale is still a negotiation. You are not going to get the best deal possible if you do not negotiate from a position of strength.

By being knowledgeable about the most important issues, you can ensure that your interests are protected during the negotiation process.

We are going to list in the next few paragraphs the top 10 issues to consider when negotiating a short sale.

1. Negotiating a Short Sale is a time-consuming and lengthy process that will take extra time to complete and close.

A short sale is an agreed-upon real estate transaction where the proceeds from the sale are not enough to cover the amount of the existing mortgage on a property.

Special approvals are required for FHA and VA loans and private mortgage insurance holders. If the property is encumbered with a second mortgage, the same process must be followed with the second lien holder.

The Lender may withdraw a prior approval right up to the funding of the transaction. Short Sale transactions require a patient Buyer with the flexibility to understand that a closing can and will be delayed until final approval is received from the mortgage company.

2. The Seller’s Agent will not be able to discuss the terms of the short sale with the lender unless the seller provides a letter that authorizes the lender to release information and or discuss the terms of a discounted pay-off with the Seller’s Agent.

Depending on where the Seller is in the short sale process (delinquency notice to cure acceleration and posting foreclosure), the negotiations may take place with either the Lender’s Loss Mitigation Department or their legal counsel.

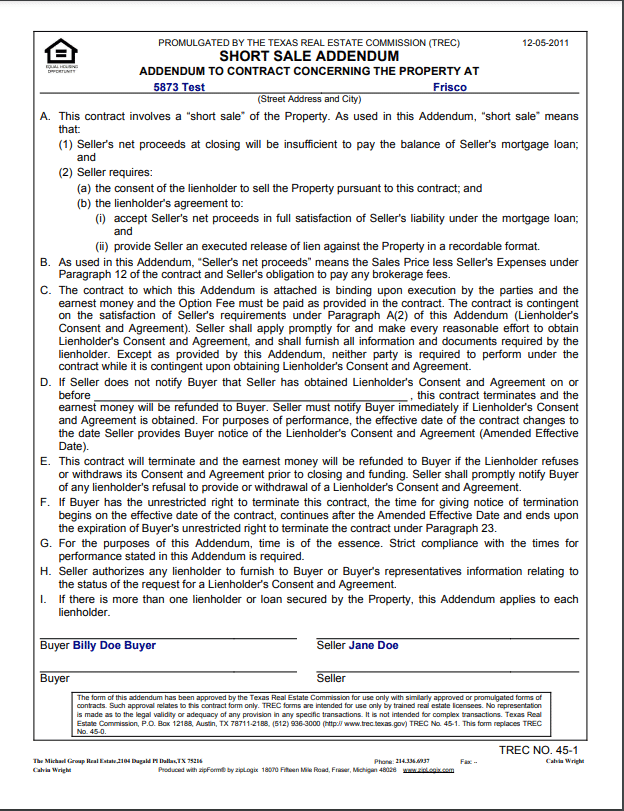

3. With Written Permission from the seller, the Seller’s Agent should mention in MLS that the transaction involves a Short Sale, in addition, a short sale addendum (TREC NO. 45-0) must be attached to the contract of the sale.

Please see the Short Sale Addendum below. This form addresses many of the drafting concerns previously dealt with in the Special Provisions paragraph.

4. The Seller must provide current financial information to the lender when requesting approval of a Short Sale.

The Lender will require that the Seller provide current financial information as a condition to approve the short sale. The Seller must begin compiling this information as soon as possible to avoid unnecessary delays in closing.

A list of the most commonly requested financial information. To view, this visit my Short Sale Services page.

5. The Seller, in many cases, will have continuing liability for the amount of the shortfall.

Realtor Liability Trap. The Seller needs to understand that even though the Lender may approve a short sale, the Seller is not necessarily released from his or her obligations on the debt remaining after the sale.

Most Lenders will agree to sign a Release of Lien for the existing mortgage and will sometimes write off the remaining balances.

Most times the lender will send over an approval letter with the amount that they approved.

The goal would be to see if the lender will take the amount as payment in full and write off the remaining debt that is owed. It’s also important that the Lender clarify exactly what they will report to a credit agency in connection with a Short Sale.

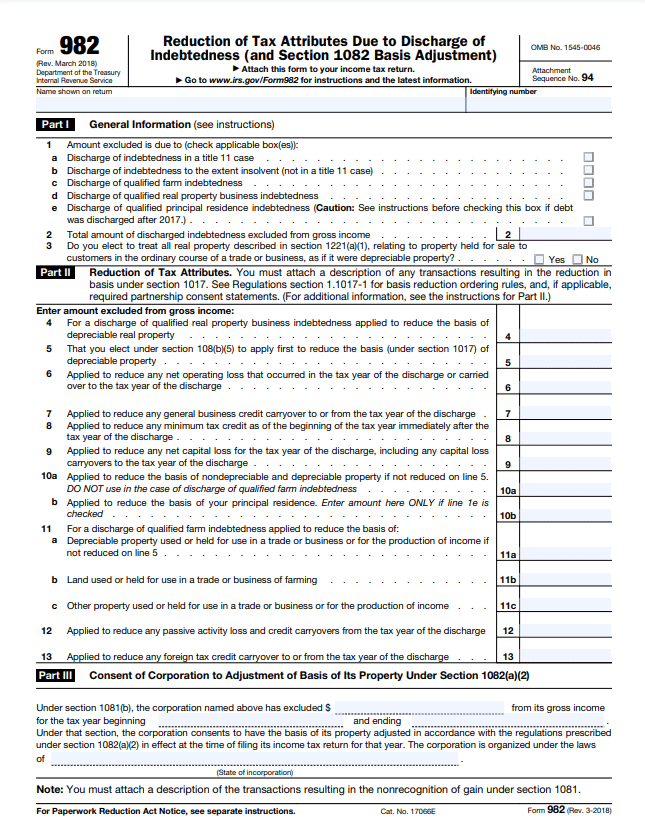

6. There may be Tax Implications resulting from the forgiveness of debt in connection with a short sale.

The remaining post-foreclosing obligation on the existing debt can be considered “a forgiveness of debt” that may result in income that is taxable to the Seller. A Lender typically sends a 1099-C to the Seller for the amount of the forgiven debt.

The seller must file this with their next year’s taxes. Remember, to seek a Licensed Accountant or CPA in regards to understanding how this works.

Important Note: Mortgage Forgiveness Debt Relief Act of 2007.

Under a new law passed by Congress in December of 2007, Lenders may no longer send 1099s to the Seller if the forgiven debt does not exceed $2 million (or $1 million if married filing separately) and involves the Seller’s principal residence.

For more information, go to IRS Home Foreclosure And Debt Cancellation.

There is a way to write the remaining balance off but you will need to seek the advice of a Licensed Accountant or CPA. The form you will need to ask them about is form 982.

7. There can be a “downside” to providing the lender with the Seller’s current financial information.

Sellers should be aware that if the short sale negotiations are unsuccessful, providing their financial information to a Lender can create problems/liability if the Seller was less than candid on their original loan application.

The Lender will have a much easier time collecting any deficiency for a post-foreclosure if they were able to collect financial information about the Seller before or during the foreclosure process.

8. There is always a risk that the Seller will file bankruptcy at the last minute.

A Seller’s bankruptcy filing affects his or her ability to convey title and may disrupt a transaction that has involved a tremendous investment of time on the part of the Agents, the Lender, and the Buyer.

9. Don’t be surprised if the lender asks the Agents to reduce their commissions and or all of the Seller’s Concessions.

Since the Lender is not receiving 100% of their pay-off, it is not unusual for the Lender to insist that the agents reduce their commissions and or the Seller’s Concession in the contract “to make the deal work.”

10. Desperate Sellers are a prime target for fraud.

Be wary of fraud when handling a short sale transaction as desperate Sellers are a prime target for dishonest “investors.”

Conclusion

If you’re facing a short sale, please reach out to me for help. I have experience with the process and can guide you every step of the way.

There are many things to consider when negotiating a short sale, but with the right team in your corner, you can get through it successfully. Don’t go through this alone–let me be your advocate. Contact me today!