As a seasoned Realtor, I understand the complexities and challenges that come with buying or selling a house in the Dallas-Ft Worth Texas area. It’s crucial to have a clear understanding of the legal aspects of real estate transactions to ensure a smooth and successful sale.

One of the most frequent concerns that sellers raise is whether a home buyer can back out of a contract. While the short answer is yes, it’s essential to know your rights as a seller and take measures to protect yourself from any potential risks.

A buyer backing out of a contract is not uncommon in the real estate industry. However, it can create significant problems for a seller, such as lost time, money, and opportunities. As a seller, you must understand the legal requirements and a better understanding of what might lead a buyer to cancel an agreement.

In this article, we’ll dive into everything you need to know about a buyer backing out of a contract.

Can A Home Buyer Back Out Contract?

Can a home buyer back out of the Contract? This is the question that many Sellers face when they are dealing with Selling their home. And the answer is Yes, a buyer can back out of a contract.

However, the contract contains particular clauses that specify the outcomes of such actions.

For example, the buyer may lose their earnest money or have to pay a penalty fee. However, there are some situations where a buyer can back out without any penalty, such as if they’re unable to secure financing or if there are Appraisal conditions that come back that need to be addressed by the Seller, and the Seller or the Buyer can not come to an agreement to do the necessary required repairs to cure the Appraisal condition.

Keep in mind this information is only for informational purposes and it is always recommended to seek the advice of a Real Estate Attorney.

If you are the Seller in the transaction and you receive the buyer’s Third Party Addendum, then you want to review the Addendum which will spell out the Buyers financial terms

When reviewing this Addendum you will see that there are a few choices that the buyer can choose from.

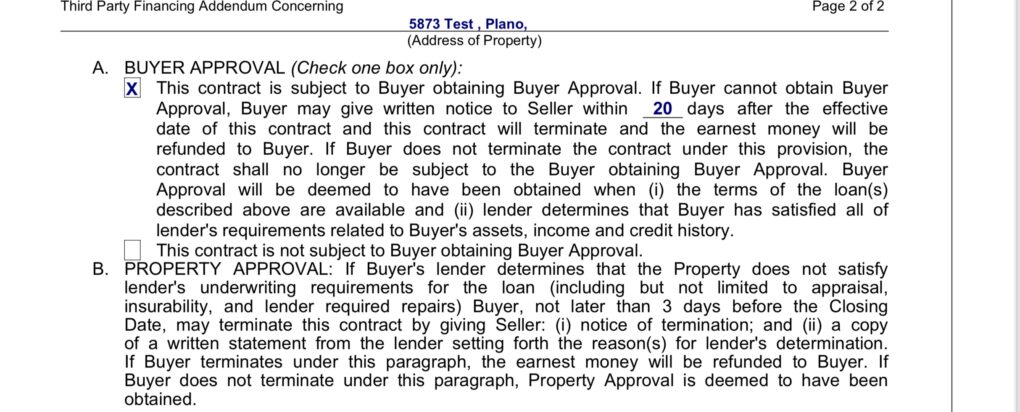

Remember, conventional financing has a few different set terms than if a buyer was going FHA or VA. When you review the Third Party Addendum one thing to pay attention to is Page 2 A. Buyer Approval.

This tells you how many days the buyer has to obtain financing. Remember that the number of days is negotiated between you and the buyer. Either the first paragraph will be checked or the second paragraph will be checked “this contract is not subject to Buyer obtaining Buyer Approval”.

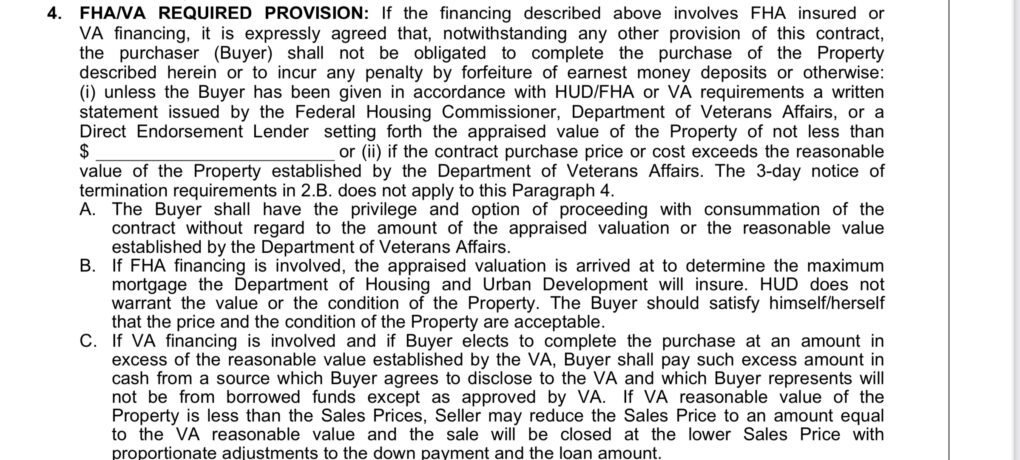

If the buyer is going to FHA or VA there is another part of the Third Party Addendum to pay attention to. This would be the FHA/ VA required provision. This provision is regarding the Appraisal value.

If for some reason the Appraisal value fall under the value that is listed in this section, the buyer has the right to terminate the contract. Or the buyer can proceed to buy the home but will have to pay the difference in the value.

This allows the buyer to terminate the contract and receive the earnest money back.

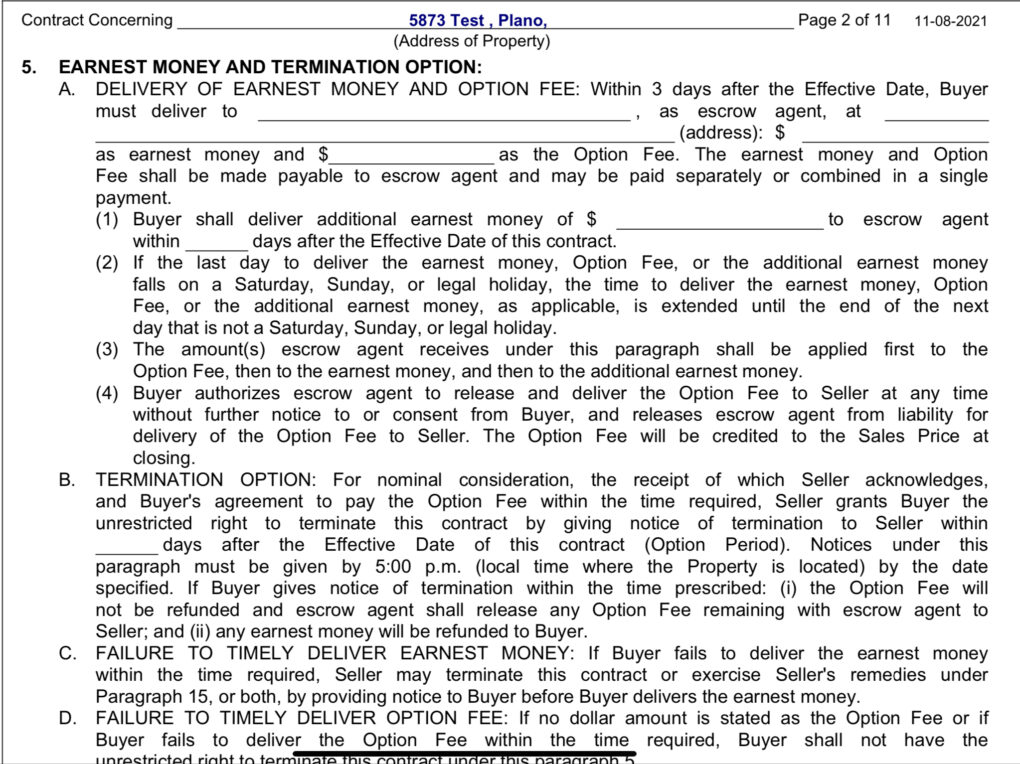

One last thing that would allow the buyer to back out would be the option period. This period is negotiable as well as the option fee. When the buyer has an option, the buyer can relay their option to terminate the contract.

Typically how it works is a buyer will tell there Real Estate Agent that they would like to relay the option to terminate.

Then the Real Estate Agent would send over a Termination of Contract check off a reason and send over the Release of Earnest money.

What Happens if a Buyer Backs Out?

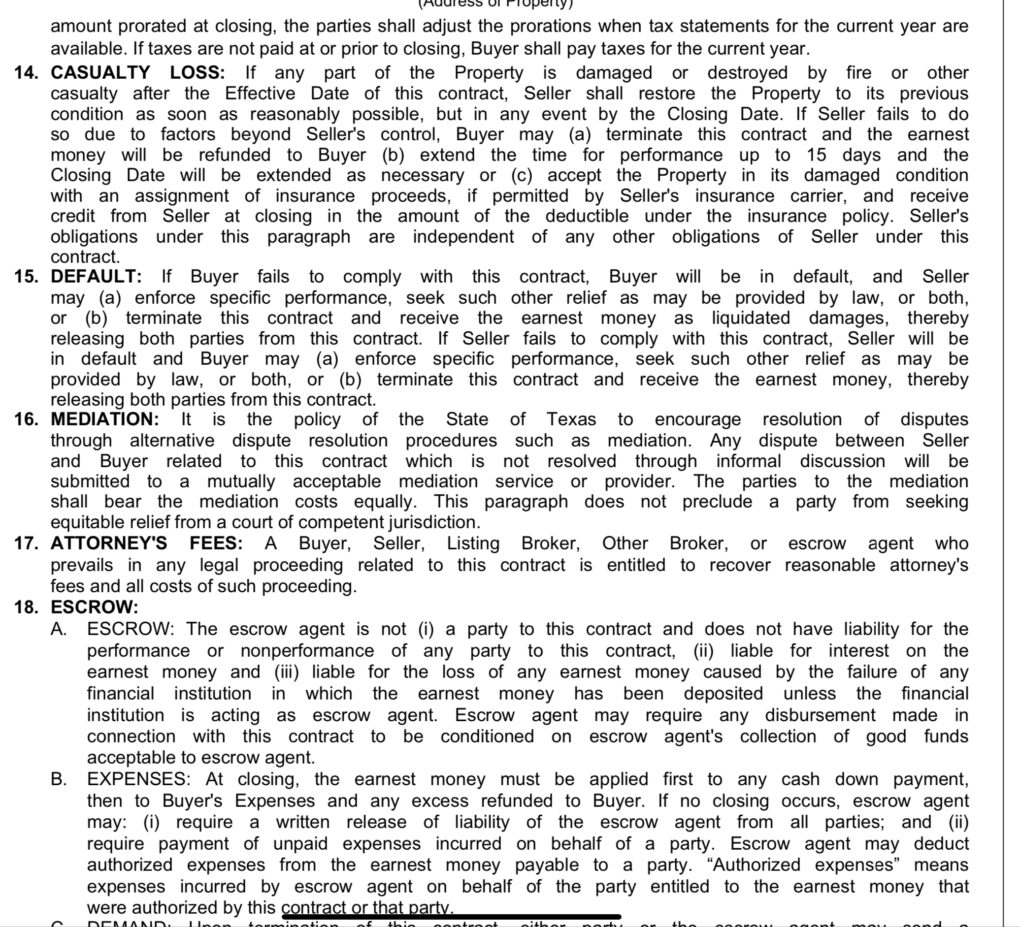

If a buyer backs out of a contract, the seller can sue for damages or keep the earnest money. However, it’s important to note that a seller can’t always keep the earnest money, and the situation can become complicated. It’s best to hire an attorney who can guide you through the legal process and protect your rights as a seller.

When you look at the Texas Real Estate Contract section 15. Spells out the Seller‘s recourse when a Buyer fails to perform. You will need to make sure you are working with a Real Estate Attorney if you choose to seek to try and get the buyer to perform.

The other thing you might consider is collecting as much earnest money as possible.

Another thing you can consider doing is having the transaction mediated with a mediation service. This is typically a third party who comes in to help try and resolve the disputed transaction. This can be found in section 16. Of the Texas Real Estate Contract.

If you are in another state this can read a little differently but it gives you some idea of what it is.

Rights of the Seller in a Contract

As a seller, you have specific rights outlined in the contract. For example, you have the right to retain the earnest money if the buyer breaches the contract. You can also sue for specific performance if the buyer fails to close on the agreed-upon date. It’s essential to understand your rights as a seller before entering into a contract.

You also want to make sure that you keep track of when the Option Money was turned in. In Texas, a buyer has 3 days from the effective date of the contract. If for some reason this day falls on the weekend then it would be the next business day which would be Monday.

If the buyer fails to turn in this amount promptly then the buyer would no longer have an option period.

Always seek the advice of your Real Estate Attorney.

Common Reasons for Buyers to Back Out

There is no way you can prevent unseen circumstances and this could be one of the main reasons buyers might decide to back out. The other reason is due to not being able to obtain financing. This could be because the buyer somehow end up buying a car or could also be due to losing their job. Not all Real Estate transactions are created equally.

It’s important to make sure you are ready by setting yourself up to win. When you set yourself up to win you are making sure that you are positioning yourself to win.

For example, if you have your home pending you might instruct your Real Estate Agent to work to obtain a backup offer. What this does is if for any reason the first buyer somehow backs out of the contract or can not obtain the financing you can immediately go to the backup buyer.

Remember in Real Estate everything is negotiable.

Final Thoughts: Tips for Successful Sales

Selling a house can be a challenging process, but by understanding the legalities involved and protecting yourself, you can have a successful sale. Hire an attorney who can guide you through the contract process, understand your rights as a seller, and have contingencies in place, can help you with the home selling process. With these tips, you’ll be on your way to a successful sale.

Selling a house in Texas can be a complicated process, but it doesn’t have to be. By understanding the legalities involved and protecting yourself as a seller, you can have a smooth and successful sale. Remember, hire an attorney, understand your rights, and have contingencies in place. With these tips, you’ll be on your way to a successful sale.